Minnesota — land of 10,000 lakes, friendly faces, and... surprisingly competitive mortgage rates? You betcha!

Buying a home in Minnesota is a fantastic dream, but the world of mortgage rates can come with a lot of questions. What interest rate should you be aiming for? How do you know if you're getting a good deal?

As your trusted community credit union, City & County Credit Union is here to explain the mortgage process and empower you to make the best financial decision. We know that finding the right rate is crucial, so let's dive into what qualifies as a "good" mortgage rate for Minnesota first-time homebuyers.

Mortgage Rates 101 for Minnesota First-Time Buyers

Before we dive into what makes a rate "good," let's cover the basics of how mortgage rates work:

What Determines Mortgage Rates?

Mortgage rates are influenced by a variety of economic factors, including:

- Federal Reserve monetary policies

- Investor demand for mortgage-backed securities

- Inflation rates

- Employment and gross domestic product (GDP) figures

These macro-level conditions impact the interest rates lenders can offer to borrowers like yourself.

Types of Mortgage Rates

There are two main types of mortgage rates:

- Fixed Rates: A fixed-rate mortgage locks in the same interest rate for the entire loan term, typically 15 or 30 years. This provides predictable monthly payments.

- Adjustable Rates: An adjustable-rate mortgage (ARM) has an interest rate that can fluctuate over the life of the loan, based on market index changes. ARMs often start with a lower introductory rate.

Pro Tip: Estimate potential mortgage payments, down payment needs, and closing costs with our user-friendly online mortgage calculator.

What Is Considered a "Good" Mortgage Rate in Minnesota?

The definition of a "good" mortgage rate can vary based on your individual financial profile and goals. However, here are some general guidelines for Minnesota home buyers:

Fixed-Rate Mortgages:

- Rates below 6% are generally considered favorable in the current market.

- Anything under 5% is an excellent deal that can significantly reduce your long-term interest costs.

Adjustable-Rate Mortgages:

- Initial rates below 4% provide substantial savings compared to fixed-rate options.

- Keep an eye on how much the rate can adjust over time and plan accordingly.

Of course, the "best" rate also depends on factors like your credit score, down payment, debt-to-income ratio, and the type of home you're purchasing. The only way to know for sure is to get pre-approved and compare offers from multiple lenders.

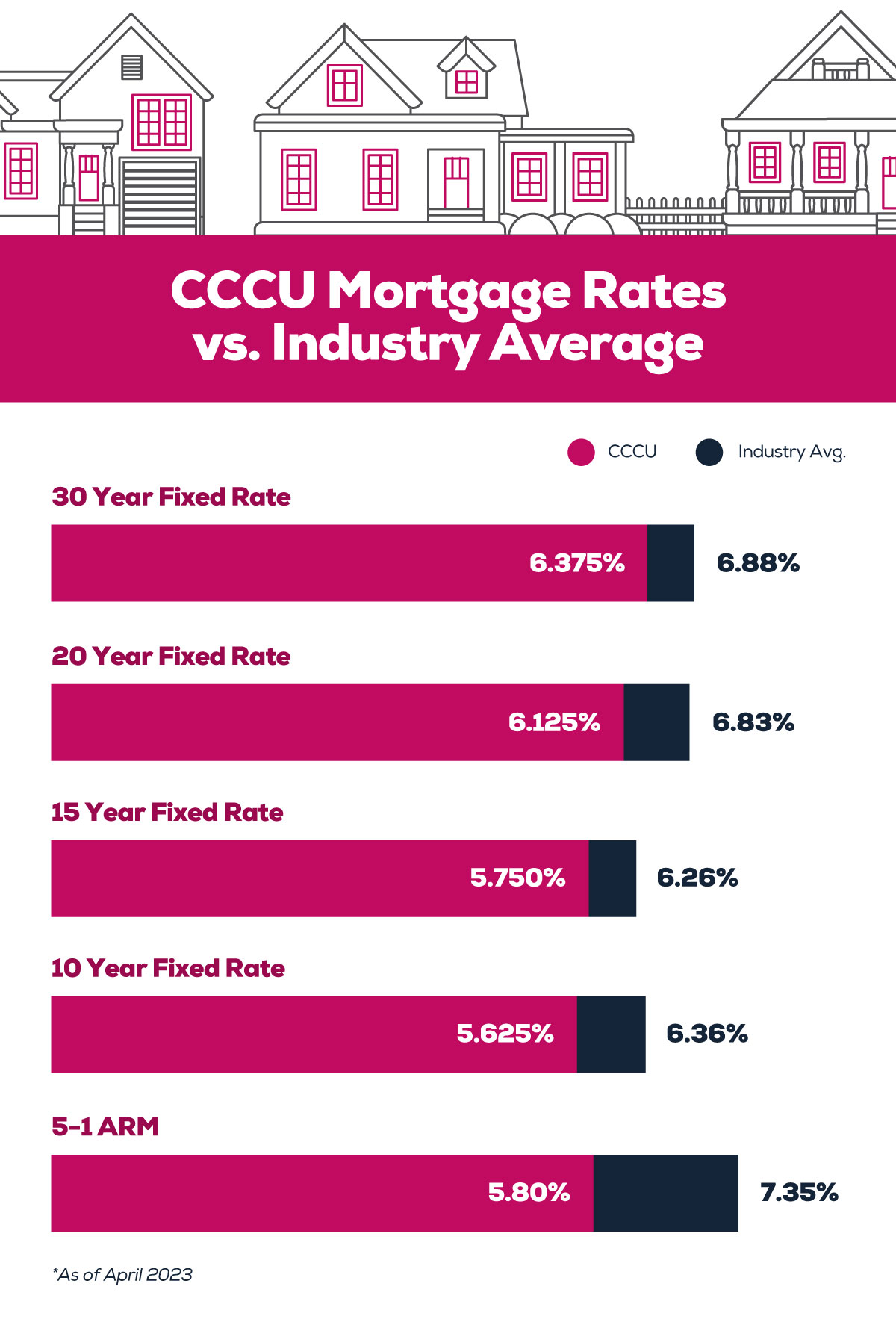

Pro Tip: Credit unions, like CCCU, are member-owned and often have lower overhead costs compared to traditional financial institutions. This can translate to competitive mortgage rates for their members!

Think Pink

Buying a home is a significant milestone in anyone's life, and we understand that it's not just a financial decision but an emotional journey. At City & County Credit Union, we're committed to making this experience as fun and stress-free as possible.

Our mortgages are designed with your unique needs in mind, and we offer a range of benefits that make owning a home more accessible and affordable than ever before. With low closing costs, competitive rates, and no hidden fees or prepayment penalties, we make sure that your dream home is within reach.

As a credit union member, you also have access to exclusive benefits:

- Mortgage pre-approval — By getting pre-approved for your mortgage, you'll gain the advantage of knowing your price range, allowing you to make confident offers and removing any uncertainty from the home-buying process.

- Affordable down payments — With CCCU mortgages, you can benefit from low down payments starting at just 3%. And if you're eligible for our Heroes & Experts Program, you may qualify for an even lower down payment, helping you get into your dream home faster and easier.

- Savings with refinancing — If you already have your home loan at another financial institution, you can refinance at CCCU and enjoy great rates and our full menu of options.

So, let's grab a cup of coffee and chat about your dream home! Together, we'll find the perfect mortgage that not only fits your budget but also makes your dream a reality. At City & County Credit Union, we're committed to being your trusted partner on this exciting journey.