Buying your first home? Get ready for an exciting ride! From touring beautiful properties to picking out paint colors, it's a thrilling process. But before you get carried away decorating your dream home, there's one not-so-fun thing you must handle: mortgage rates.

We know, mortgage rates aren't exactly riveting. But they play a huge role in determining what your monthly house payment will be, so it's crucial to understand what makes rates rise and fall.

What Are Mortgage Interest Rates?

To put it simply, a mortgage interest rate represents the cost of borrowing money to purchase a home. This cost is typically shown as an annual percentage rate.

When you take out a home loan from a lender like City & County Credit Union, you agree to pay back the amount you borrowed plus interest charges over a defined repayment term.

The specific mortgage rate you receive will directly influence your monthly home loan payments and total interest costs over the life of the loan.

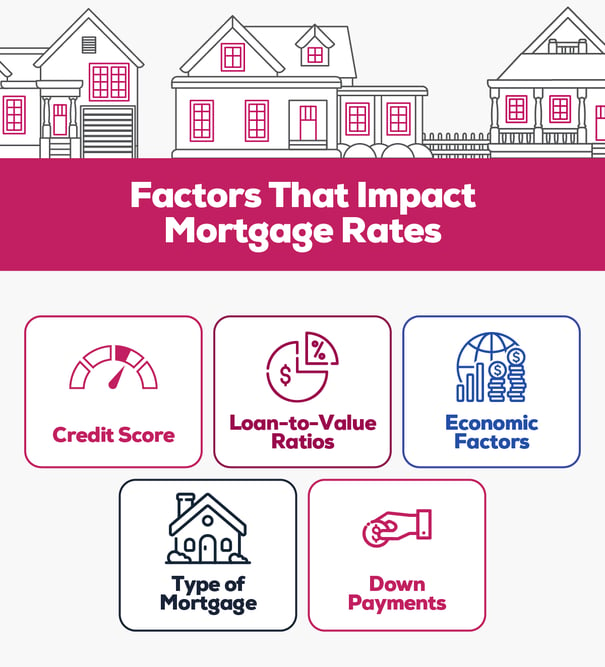

That's why it's so crucial to understand the key factors that impact mortgage rate pricing as you navigate the homebuying process. Knowledge is power when it comes to securing a rate and loan terms that fit your budget and financial goals!

Factor 1: Credit Scores

Your credit score acts like a financial report card. It shows lenders how reliable you are at paying back debts.

The higher the score, the more trustworthy you appear. That means better chances at securing lower mortgage rates, saving you money.

Before applying, check your credit report and fix any mistakes that may be lowering your score. Aim for 740 or higher to qualify for the best rates!

Factor 2: Loan-to-Value Ratios

When getting a mortgage, lenders calculate your loan-to-value (LTV) ratio. This compares your loan amount with the home's value.

For example, if your home is worth $250,000 and you borrow $200,000, your LTV ratio is $200,000/$250,000 = 80%.

A lower LTV ratio is better for you and the lender, as you can qualify for a lower interest rate and save money over the life of the loan.

Here's a tip to reduce your ratio: Make a larger down payment, which lowers the amount you need to borrow. Ask your loan officer how different down payment amounts could impact your rate.

The more you put down, the better rate you can get. Finding the optimal LTV ratio could save you thousands!

Factor 3: Economic Factors

Big economic forces also impact mortgage rates. When the economy is thriving, rates often rise as demand for loans increases. But when growth slows, rates usually fall as lenders compete for business.

While you can't control the economy, understanding these macro conditions is helpful when getting a mortgage. Doing research could score you a lower rate.

For example, timing your purchase when rates dip in a slower economy can save you thousands over the life of your loan.

Factor 4: Type of Mortgage

The mortgage product you choose affects your rate. Options like fixed-rate or adjustable-rate mortgages determine rates differently.

Fixed-rate mortgages lock in a steady rate for the full loan term. Adjustable-rate mortgages fluctuate based on market conditions.

Chat with your loan officer to weigh the pros and cons for your goals and budget. They can help you select the most suitable mortgage type that could score you the best rate.

Factor 5: Down Payments

Generally, larger down payments earn you lower rates. Putting down 20% or more shows lenders you can manage mortgage payments.

But programs exist allowing less than 20% down. You may pay a slightly higher rate but can still buy with just 3% to 5% down.

Talk to your loan officer about options for your budget. While larger down payments score better rates, a smaller one paired with a sound financial profile can still land you a great deal.

The key is balancing your down payment, rate, and monthly payment to find the right mortgage fit. Don't assume you need 20% down to get started — explore all avenues on the path to homeownership!

Confident Mortgage Shopping Starts Here

Navigating mortgage rates can make you feel like you’re wandering through a maze. But arming yourself with knowledge gives you power over the process. Now you can shop confidently, understanding what impacts pricing.

At City & County Credit Union, our experts provide personalized guidance so you can forget rate confusion and focus on the thrill of homeownership. We stand by your side, offering:

- Low closing costs

- Competitive rates

- No hidden fees

We simplify the mortgage process so you can turn house-hunting into home-finding. Reach out to get started today!