Every day, clever identity thieves are cooking up new schemes to snag their next victim. These aren't your old-school credit card scams anymore — today's fraudsters have some seriously creative tricks up their sleeves.

But here's the good news: once you know what to watch for, you can spot their tactics a mile away. We'll walk you through seven warning signs of identity theft, helping you stay one step ahead and protect your financial future.

What is Identity Theft? Understanding the Basics

Gone are the days when identity theft just meant a swipe of your credit card. Today, fraudsters piece together a puzzle of your life — from medical records to tax forms, social media footprints to data breaches. These criminals aren't just after your wallet; they're building entire fake identities, opening new accounts, and even getting medical care using your personal information.

Gone are the days when identity theft just meant a swipe of your credit card. Today, fraudsters piece together a puzzle of your life — from medical records to tax forms, social media footprints to data breaches. These criminals aren't just after your wallet; they're building entire fake identities, opening new accounts, and even getting medical care using your personal information.

The damage can ripple through your credit score, bank accounts, and legal records — but spotting their tricks early can save you from a world of headaches.

7 Surprising Identity Theft Warning Signs

1. Unexpected Changes in Your Credit Score

Your credit score tells a story — make sure it's telling yours! A sudden drop could mean someone has opened accounts in your name or maxed out credit cards you never used. Keep an eye on your score and investigate any unexpected changes right away.

2. Unfamiliar Transactions on Your Bank Statements

Those tiny mystery charges matter more than you think. Identity thieves often test stolen cards with small purchases before making bigger moves. Keep tabs on your transactions and watch for charges you don't recognize — even small ones can signal serious problems ahead.

3. Bills or Statements Stop Arriving

3. Bills or Statements Stop Arriving

Missing statements aren't always a mail mix-up. Clever thieves sometimes redirect your bills to hide their tracks while they rack up charges. Stay in control by keeping an eye on both your mailbox and your online accounts.

4. Receiving Calls from Debt Collectors for Unknown Debts

Strange collection calls might be your first clue that something is wrong. Identity thieves often open accounts, run up bills, and vanish — leaving you with the collectors. Save those voicemails and keep notes — they'll help prove your case.

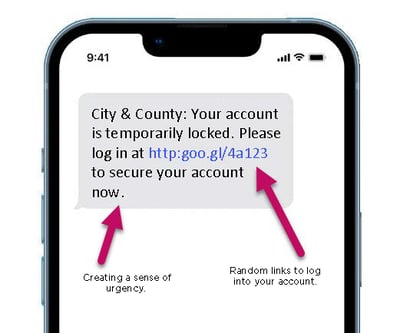

5. Suspicious Email or Text Messages Asking for Personal Information

Today's scams look amazingly real, complete with logos and urgent warnings about your account. But here's the truth: no legitimate bank will ever ask for your password or PIN through email or text. When in doubt, pick up the phone and call directly.

6. Unexplained Tax Issues or IRS Notifications

Tax surprises are never fun, especially when someone else files "your" return or uses your Social Security number for work. Watch for IRS notices about duplicate filings or income from jobs you've never had — these need quick action to resolve.

7. Unfamiliar Accounts on Your Credit Report

Strange charges aren't the only red flag to watch for — phantom accounts can pop up too. If you spot loans, credit cards, or inquiries you never signed up for, someone might be shopping with your name.

Immediate Steps to Take if You Suspect Identity Theft

Time matters when dealing with identity theft. The faster you act, the better your chances of stopping thieves and protecting your finances. Take these steps immediately:

Time matters when dealing with identity theft. The faster you act, the better your chances of stopping thieves and protecting your finances. Take these steps immediately:

- Contact your financial institutions right away — they can help secure your accounts

- Place a fraud alert on your credit reports with all three major credit bureaus

- Experian: (888) 397-3742

- Transunion: (800) 680-7289

- Equifax: (888) 766-0008

- File a detailed report with the FTC at IdentityTheft.gov

- Consider a credit freeze for maximum protection — it's free and effective

Keep detailed records of all your communications and reports — they'll be important as you restore your financial security.

How to Protect Yourself from Identity Theft

The best defense is a strong offense. While no single step can guarantee protection, these security habits will help reduce your risk:

- Monitor your credit regularly — review reports and watch for suspicious activity

- Use strong, unique passwords for all your accounts

- Be cautious with personal information online — especially on social media

- Consider identity theft protection services for an extra layer of security

Making these practices routine creates a solid shield against potential identity thieves.

CCCU's Identity Theft Protection Services: Your Shield Against Fraud

Now that you know the warning signs, let's add an extra layer of protection to your financial life. Our comprehensive protection services work around the clock, watching for suspicious activity while you focus on what matters most.

From instant alerts that ping your phone to dedicated fraud specialists who have your back, we'll help keep your identity locked down tight. Think of us as your personal financial security team — because at CCCU, protecting your future is what we do best.