Does your credit score feel like a puzzle wrapped in a mystery? We're here to help unravel the secrets and simplify how this important number works.

Knowing your score empowers you to take control of your financial reputation. Let's explore what's behind that 3-digit number and how you can boost it.

The Basics of Credit Scoring

Credit scores range from 300 to 850. The higher the better! Anything above 670 is considered good credit, while most people have scores around 700.

Lenders check your credit score to gauge how likely you are to repay debts. Higher scores signal you're a trustworthy borrower, increasing approval odds for credit cards and loans.

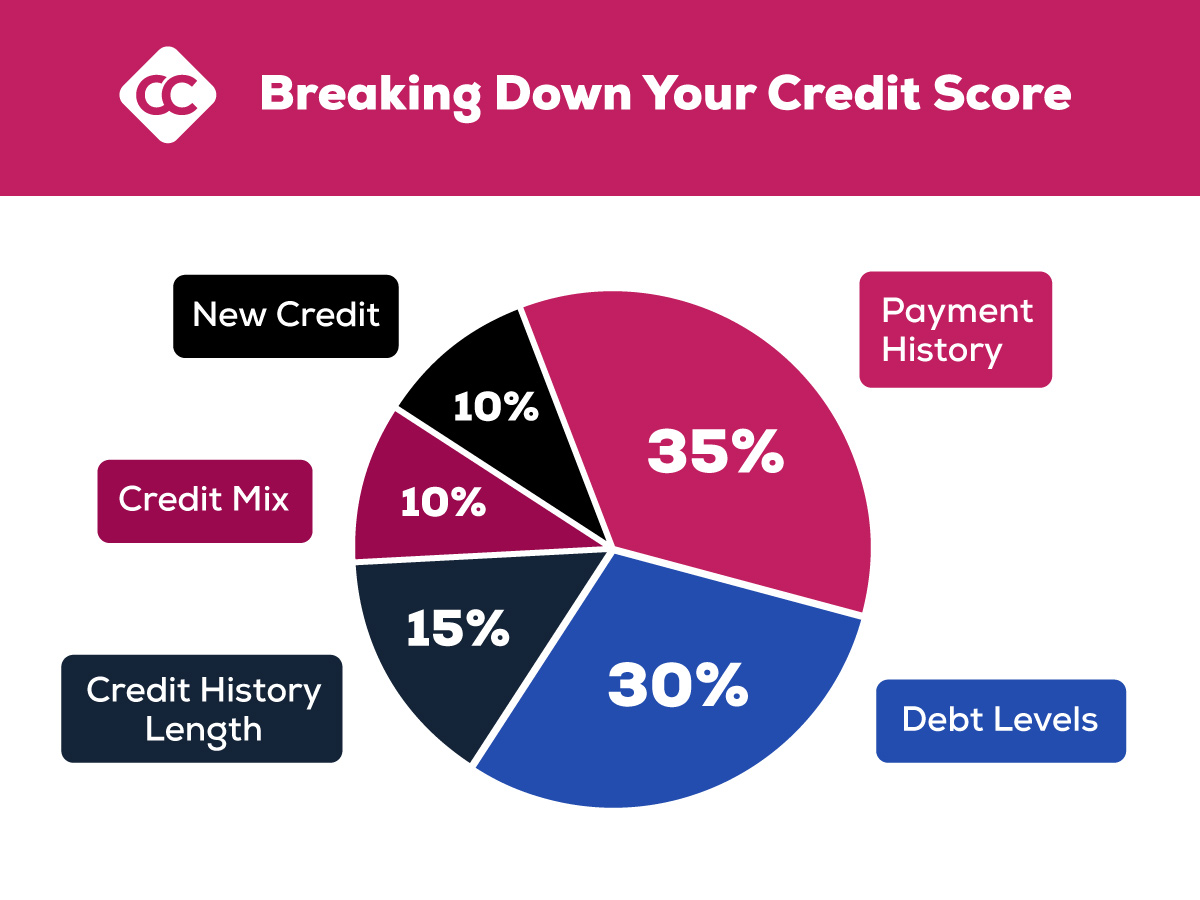

Your score comes from information in your credit report, specifically:

- Payment History (35%): Stay on time with bills. Late or missed payments hurt.

- Debt Levels (30%): High balances raise red flags. Keep balances under 30% of your credit limit.

- Credit History Length (15%): A longer history looks better. It shows you're in it for the long haul.

- Credit Mix (10%): Having different types of credit looks good.

- New Credit (10%): Opening many new accounts can temporarily lower your score. Pace yourself.

What Doesn’t Affect Your Score?

Your credit score focuses solely on how you handle credit based on credit bureau data. Your income, assets, age, and other personal details outside of credit usage are not factored in.

Strategies To Boost Your Score

The #1 way to raise your score is to make on-time payments in full every month. Only charge what you can realistically repay.

Maintaining low credit utilization — under 30% of your limit — also gives your score a nice boost. Having a small amount of credit and using it responsibly shows lenders you can handle it well.

A Brief History of Credit Scoring

Before 1989, lenders assessed "creditworthiness" more subjectively, often considering personal attributes like age, race, and marital status.

Then Fair Isaac Corporation introduced the FICO credit score system, still used today. It focused strictly on financial behaviors from credit bureau data, ignoring personal particulars. By the 1990s, FICO scores were widely adopted by lenders.

Take Control of Your Credit Score

Understanding your credit score helps you manage it wisely to unlock financial opportunities. At CCCU, we're here to empower you to make smart money moves that steadily build your score over time. Let's chat about the best options tailored to your unique needs!