Building a healthy savings account is a fantastic goal, and City & County Credit Union is here to cheer you on! We know every dollar counts, so we've put together five engaging ways for you to save an extra $100 this month.

These challenges are designed to be simple and achievable, yet impactful. No drastic changes to your lifestyle required! Let's jump right in and explore how you can supercharge your savings.

1. Try the Biweekly Savings Challenge

Our first challenge is perfect for those who prefer a gradual approach to saving. It's called the Biweekly Savings Challenge, and here's how it works:

- Start small: Set aside just $10 in the first two weeks of the month.

- Gradually increase: Bump it up to $20 for the next two weeks.

- Repeat and grow: Increase your savings by $10 every two weeks.

By the end of the month, you'll have socked away a total of $100! This challenge is a fantastic way to gradually build your savings habit without feeling overwhelmed. It's a small step with a big payoff!

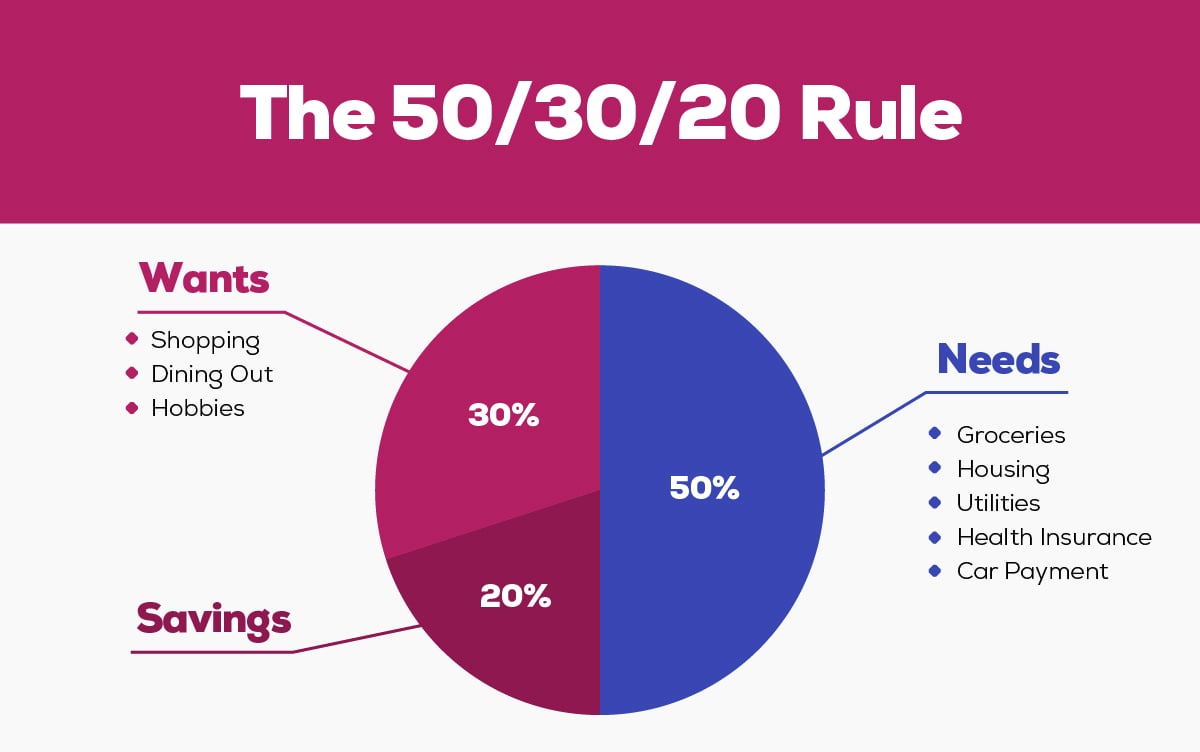

2. Use the 50/30/20 Budgeting Method

Feeling like your money is slipping through your fingers? The 50/30/20 budgeting method can be a game-changer! This popular strategy helps you take charge of your finances by dividing your income into clear categories:

The beauty of this method lies in its simplicity and flexibility. It ensures you're covering your necessary expenses while still allowing room for the things you enjoy. Plus, by allocating 20% towards savings and debt repayment, you're actively working towards a brighter financial future.

PS: Need some help getting started? We have free online calculators that crunch the numbers and build a budget for your needs!

3. Sell Unused Items

Everyone accumulates unused items over time. But did you know those forgotten treasures could be hiding a financial boost? Here's a fun challenge: turn your clutter into cash!

Dedicate some time to decluttering your home. Look through closets, drawers, and even the garage for items you no longer need or use. This could be anything from clothes and electronics to unused sporting equipment or old books.

Once you've identified your sellable items, you can sell the items on an online marketplace or host a garage sale. By decluttering and selling unused items, you'll achieve two goals at once: freeing up space in your home and putting extra cash in your savings account. It's a win-win!

4. Complete a No-Spend Week

Sometimes, a fresh perspective can reignite your motivation. That's where the no-spend challenge comes in! For seven days, challenge yourself to spend only on essential expenses like groceries, gas, and bills. Skip the takeout and impulse purchases, and see how much you can save by focusing on what you truly need.

Remember, this is a temporary challenge, not a lifestyle change. If an unexpected expense arises, don't be discouraged! The goal is to be more conscious of your spending and see the positive impact it can have on your savings.

5. Find a Savings Account to Help Reach Your Goals

You've conquered the challenges, embraced the declutter, and streamlined your spending habits. Now it's time to make sure your hard-earned savings are working for you! Here at City & County Credit Union, we believe the right savings account can be the final piece of the puzzle to help you reach your $100 savings goal (and beyond!).

CCCU's Saving Account Options

Here's a look at some of our most popular options to help you find the perfect fit:

Primary Savings Account

This is a fantastic starting point for anyone new to saving or prefers a simple, low-maintenance option. With a low $5 minimum balance requirement, it's easy to get started. Your Primary Savings Account earns a competitive dividend, which is paid out quarterly.

Daily Interest Savings

Do you have a specific goal, like a dream vacation or a down payment on a car? The Daily Interest Savings Account is a great choice. This account allows your money to grow faster with interest that accrues daily and is compounded quarterly. There's no minimum balance required, making it ideal for any savings goal of any size.

Automatic Savings Account

Building consistent savings habits is key to long-term financial success. Our Automatic Savings Account makes it effortless. Simply set up an automatic transfer from your checking account and watch your savings accumulate over time.

Plus, you'll earn a higher interest rate on your saved funds compared to our traditional savings accounts. There's no minimum balance required, but keep in mind there's a limit of one withdrawal per month to encourage regular saving.

Money Market Account

Looking to maximize your earnings while still maintaining easy access to your cash? Then a Money Market Account might be the perfect solution. This account offers a competitive interest rate and allows you to write checks or use a debit card for everyday purchases. There's a minimum balance requirement of $2,500, making it a good option for those with a larger emergency fund or short-term savings goals.

Ready to take the next step?

Visit a City & County Credit Union branch or browse our website to explore our savings accounts in more detail. Let's find the perfect account to turn your savings goals into reality!