Worried about a potential recession on the horizon? You’re not alone. A Bloomberg survey with 38 economists unanimously agreed that there’s a 70% chance the United States will enter a recession within the year. That’s up from 65% in November and 30% in June.

The state of the economy is a topic that can trigger anxiety and confusion for many people, especially during times of uncertainty. And while the thought of a potential recession may be daunting, it’s important to remember that you can take steps to prepare and protect your finances.

You don’t have to go through this alone. At City & County Credit Union, we’re here to help navigate these uncertain times. That’s why we put together a list of five simple and surefire strategies to recession-proof your finances and weather any potential economic storm.

1. Create a Budget and Stick to It

When recession-proofing your finances, building a budget is an essential first step. A budget helps you get a clear understanding of your income, expenses, and spending habits. Plus, it allows you to more easily identify areas where you may need to cut back and save money.

Start by tracking your spending for a month or two to get a clear understanding of your income and expenses. Then, list all your outgoing expenses and prioritize them based on necessity. Set spending limits for each category and automate your savings so that a portion of your income is automatically deposited into a savings account. Use budgeting apps or spreadsheets to help you stay organized and monitor your progress.

While building your budget, it’s important that you remember to be realistic and don’t get too hard on yourself if you slip up. Instead, use it as a learning opportunity to adjust your plan. With these tips, you can build a budget that works for you and feel more in control of your financial future, even during uncertain economic times.

2. Build an Emergency Fund

One of the most important steps you can take to recession-proof your finances is to build an emergency fund. An emergency fund is a savings account that you can tap into in case of unexpected expenses, such as a job loss, medical bills, or home repairs. A good rule of thumb is to aim to save at least three to six months' worth of living expenses.

One of the most important steps you can take to recession-proof your finances is to build an emergency fund. An emergency fund is a savings account that you can tap into in case of unexpected expenses, such as a job loss, medical bills, or home repairs. A good rule of thumb is to aim to save at least three to six months' worth of living expenses.

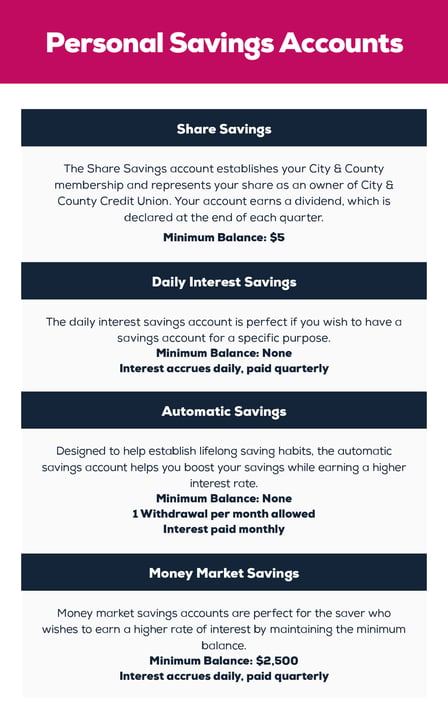

To build your emergency fund, start by setting a savings goal and create a budget that includes a regular savings contribution. Look for ways to cut back on expenses and redirect that money into your emergency fund. You could also look into opening a high-yield savings account to earn a higher interest rate on your savings.

It may take time to build up your emergency fund, but the peace of mind it provides is well worth the effort. With an emergency fund in place, you can face future unexpected expenses without worrying about the impact it will have on your financial stability.

3. Diversify Your Investments

When recession-proofing your finances, diversifying your investments is another important strategy to consider. Diversification involves spreading your investments across various asset classes, including stocks, bonds, or real estate.

By diversifying, you can help manage risk and potentially increase returns over the long term. However, it's important to note that diversification does not guarantee a profit or protect against loss in a declining market.

It’s crucial to seek the advice of a financial professional who can help you develop an investment strategy that aligns with your individual needs and circumstances. They can assess your risk tolerance, investment goals, and timeline to help you make informed investment decisions. With a diversified investment portfolio tailored to your unique needs, you can feel more confident and prepared for whatever economic challenges may come your way.

4. Create Multiple Streams of Income

Creating multiple streams of income is a smart strategy when planning for a potential recession because it provides financial security and flexibility during times of economic uncertainty.

When you diversify your income sources, you can reduce reliance on a single income stream — this is particularly important during a recession when layoffs and job losses are relatively common. Not to mention, creating multiple streams of income can empower you to take advantage of new opportunities that may arise during a recession.

For example, you might be able to pivot to a different industry or start a side business to supplement your income. This doesn’t just help you weather the storm temporarily, but it also sets you up for long-term financial success!

5. Make Sure Your Financial Institution Is on Your Side

When it comes to recession-proofing your finances, having a financial institution on your side that puts your interests first can make all the difference. Some financial institutions may prioritize their own profits over the needs of their customers, which can lead to hidden fees, high interest rates, and other unfavorable terms.

By choosing a partner that puts your needs first, you can feel confident that you are getting fair and transparent terms that work for you. Look for financial institutions that offer competitive interest rates, low fees, and helpful financial tools and resources, such as budgeting and savings calculators. It's also important to choose a credit union with a strong reputation for customer service and support.

When you work with a financial institution like City & County Credit Union, you will feel secure and prepared for any future economic challenges. Not to mention, you’ll be able to enjoy the peace of mind that comes with knowing we are truly on your side — helping you achieve all of your goals and build a brighter future.