Bank

-

Open Account

- Checking/Savings (Opens in new window)

- Auto Loan (Opens in new window)

- Personal Loan (Opens in new window)

- Line of Credit (Opens in new window)

- Mortgage (Opens in new window)

- Home Equity Line of Credit (HELOC) (Opens in new window)

- Home Equity Loan (Opens in new window)

- Credit Card (Opens in new window)

- Student Loan

The Ultimate Guide to Financial Wellness

Are you tired of feeling overwhelmed by financial planning? We get it, money can be a daunting topic, but it doesn't have to be! That's why we have created a collection of easy-to-understand resources that empower you to take control of your finances — all from the comfort of your own couch. From budgeting tips to building healthy financial habits, City & County Credit Union is here to support you every step of the way.

What Is Financial Wellness?

Money can be a powerful tool for building the life you want, but it can also be a source of stress and uncertainty. That's where financial wellness comes in — it's all about feeling confident and in control of your finances, both now and in the future. Think of it as your own personal financial superhero, helping you manage your money and achieve your goals.

Money can be a powerful tool for building the life you want, but it can also be a source of stress and uncertainty. That's where financial wellness comes in — it's all about feeling confident and in control of your finances, both now and in the future. Think of it as your own personal financial superhero, helping you manage your money and achieve your goals.

So, what are the key components of financial wellness? Well, there's budgeting (AKA the MVP of personal finance), which helps you track your income and expenses and make the most of every dollar. Then there's saving (hello, emergency fund!), investing (letting your money do the heavy lifting), debt management (kicking those credit card balances to the curb), and retirement planning (so you can spend your golden years in style). Master these areas, and you'll be well on your way to financial peace of mind.

Budgeting

Budgeting — the word alone can send shivers down your spine. It may feel overwhelming, restrictive, or just plain boring. But here's the thing: budgeting is essential for achieving financial freedom. It's the superhero of personal finance that can help you track your income and expenses, prioritize your spending, and plan for the future.

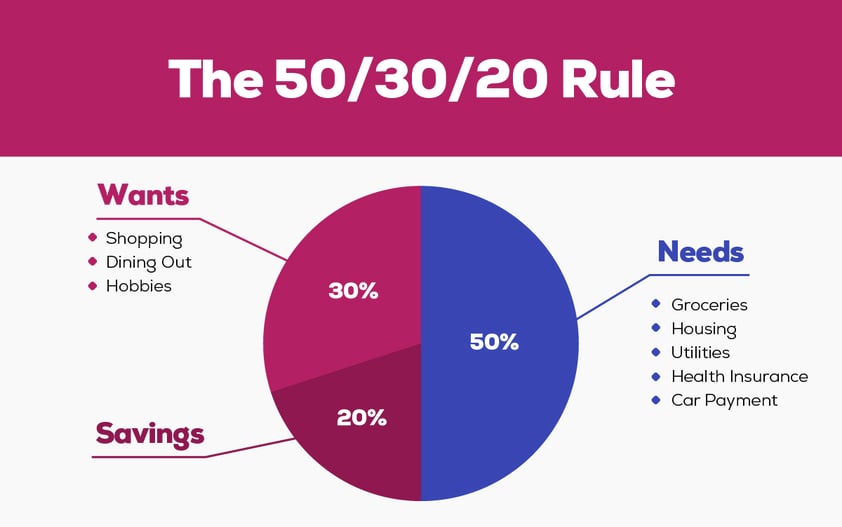

The 50/30/20 Rule

One effective budgeting method to consider is the 50/30/20 rule, which provides a simple framework for managing your expenses and savings. Let's break it down — the 50/30/20 rule suggests dividing your income into three main categories: needs, wants, and savings.

- Needs: Needs encompass the essential expenses that you can't live without, such as housing, transportation, and food. These necessities typically require around 50 percent of your net income. By budgeting for your needs, you ensure that your basic requirements are met and give yourself a solid foundation for financial stability.

- Wants: Next, we have wants. Wants are the things that bring joy and enhance your lifestyle but are not vital for survival. They encompass a range of discretionary expenses, including dining out, entertainment, subscriptions, hobbies, and more. Allocating around 30 percent of your income towards wants allows you to enjoy life's pleasures while still maintaining a healthy financial balance. Remember, wants can be flexible, and you have the power to prioritize and adjust them based on your current circumstances.

- Savings: Finally, we arrive at savings—an essential component of any budget. Savings are the fuel that propels your financial future. Whether you're building an emergency fund, saving for retirement, or working toward specific goals, allocating 20 percent of your income toward savings is crucial. Cultivating a savings habit ensures that you're prepared for unexpected expenses, secures your long-term financial well-being, and gives you peace of mind.

While the 50/30/20 rule provides a helpful guideline, it's important to remember that everyone's financial situation is unique. Adjustments may be necessary based on your income, expenses, and personal goals. The key is to develop a budgeting approach that works best for you.

Tracking Expenses

Congratulations on creating a budget and setting your financial goals! However, the real challenge lies in sticking to your budget and avoiding common traps like overspending on non-essential items or neglecting irregular expenses. To overcome these challenges, it's crucial to constantly review and assess your spending habits. Here are some steps you can take to effectively track your expenses and stay on top of your financial game.

- Record Your Monthly Income: Take into account all sources such as salaries, bonuses, or side hustles. It's essential to have a clear understanding of how much money is flowing into your account each month. This step sets the foundation for accurate expense tracking.

- Identify Your Fixed Monthly Expenses: Include predictable costs that remain consistent month after month. Examples of fixed expenses include rent or mortgage payments, utility bills, insurance premiums, and loan payments.

- List Your Non-Monthly Fixed Expenses: Aka, those bills that occur less frequently, such as quarterly or semi-annual payments. These could include property taxes, annual subscriptions, or insurance premiums. To incorporate these expenses into your budget effectively, divide the total amount by the number of months in the payment cycle. This calculation reveals the monthly allocation required to prepare for these expenses, preventing any surprises down the line.

- Compile a Comprehensive List of Your Variable Monthly Expenses: These expenses fluctuate from month to month and encompass various categories like groceries, transportation, entertainment, and dining out. This step helps you gain a clear understanding of your spending patterns and aids in aligning them with your budget.

- Compare Your Income to Your Outgoing Expenses: The moment of truth — this step unveils whether your cash flow is positive or negative. A positive cash flow means your income is sufficient to cover your expenses comfortably, allowing you to meet your financial obligations while pursuing your desired lifestyle. Conversely, a negative cash flow indicates that your expenses outweigh your income, potentially leading to financial stress and reliance on credit cards or debt to make ends meet.

To reverse a negative cash flow, you have two options: reduce your spending or increase your income. While the idea of increasing your income may seem appealing, it's often more practical and achievable to focus on reducing your spending. By identifying areas where you can cut back without compromising your needs or quality of life, you can bring your expenses in line with your income and regain control over your financial situation.

Remember, creating a spending plan is not a one-time task but an ongoing process that demands effort, commitment, and periodic adjustments. Your spending plan provides a precise picture of your available funds, financial priorities, and actual spending habits. By achieving a harmonious balance between your income and expenses, you lay a solid foundation for a secure financial future.

CCCU Budgeting Resources

At City & County Credit Union, we are dedicated to helping you achieve financial success through effective budgeting. We understand that creating a budget can feel overwhelming, but rest assured that with our range of resources and tools, taking control of your finances and reaching your goals has never been easier.

To kickstart your budgeting journey, we offer a budget prep worksheet that provides an easy-to-follow format for establishing the foundation of your budget. This comprehensive worksheet will guide you through the process, ensuring that no aspect of your finances is overlooked. With this tool, you'll gain clarity and confidence in managing your money effectively.

Saving

Saving money is a crucial component of achieving financial wellness. But, if we’re being honest, the thought of saving money can feel restrictive or even impossible to fit into your budget. However, setting aside money regularly is essential for building an emergency fund, planning for future expenses, and reaching long-term financial goals like buying a home or retirement.

So, how can you get started with saving? The first step is to set realistic savings goals. Determine what you're saving for and how much you'll need to achieve that goal. It's helpful to break down your goals into short-term and long-term objectives. A short-term goal could be to save for a vacation, while a long-term goal might be to save for a down payment on a house.

Once you have your goals in mind, it's time to create a savings plan. Start by analyzing your income and expenses to figure out how much you can realistically save each month. Don't be discouraged if you can only save a few dollars at first; even small amounts can add up over time!

Pro Tip: One useful tip is to set up automatic transfers from your checking account to your savings account. This way, you won't have to remember to transfer the money each month - it will happen automatically.

Remember, successful saving is all about making it a habit. By setting achievable goals, creating a savings plan, and automating your savings, you'll be well on your way to achieving financial wellness.

Building an Emergency Fund

We all have those moments of bad luck—a sudden illness, a car accident, or a leaky pipe. But fear not! You can conquer these challenges without burning a hole in your wallet by building an emergency fund.

First things first, it's time to reframe the way you think about your emergency fund. It's not just another savings account that you dip into whenever you're a little short on cash. It's a separate account specifically for emergencies that you hope you never have to touch.

But where should you keep this precious emergency fund? A dedicated savings account is the easiest and most accessible option. Just make sure it's a separate account from your other savings and spending accounts, so you're not tempted to spend it on non-emergencies. You can also consider other options like multiple CDs or a money market account if they align with your financial goals.

Now, here's the million-dollar question: how much should you save? Experts recommend having enough to cover your essential needs for 3-6 months, including rent or mortgage payments, bills, food, and debt payments. But let's be honest, the bigger the emergency fund, the better. Imagine having a full year's worth of funds to fall back on in case of a crisis.

A Guide to CCCU's Saving Accounts

If you're looking for a safe and reliable way to save your money, CCCU offers a variety of savings accounts to choose from. Each account has its own unique features and benefits, so it's important to understand the differences between them to find the best fit for your financial goals.

Primary Savings Account

When it comes to personal finance, a primary savings account is an essential tool to have in your arsenal. With a minimum balance of just $5, it's an excellent option for anyone looking for a basic savings account. Plus, the account earns dividends, which are declared quarterly, providing an added bonus for your savings efforts. Just keep in mind that if you close the account before the end of the quarter, you won't earn the dividend for that period. Overall, a primary savings account is a simple, yet valuable, account type to have in your financial toolkit.

Daily Interest Savings Account

The Daily Interest Savings account is designed for those who want to save for a specific purpose while earning interest on their savings. The account has no minimum balance requirement and interest accrues on a daily basis, paid out quarterly. With the Daily Interest Savings account, you can watch your savings grow faster and achieve your goals sooner.

Automatic Savings Account

The Automatic Savings account is a great option for those who want to develop and maintain strong saving habits. This account makes it easy to grow your savings while earning a competitive interest rate.

With no minimum balance required, this account allows you to start saving right away. You can make one withdrawal per month, but be mindful that there is a $20 fee for additional withdrawals. Interest is paid monthly, giving you the opportunity to watch your savings grow over time.

Money Market Account

With a higher minimum balance requirement, the Money Market account is perfect for those who want to earn a little extra interest without locking up their funds in a long-term investment. It's a great option for building an emergency fund, as you'll have immediate access to cash with the added bonus of earning extra interest. Just be sure to maintain the minimum balance to avoid any fees.

Certificate of Deposit (CD)

A Certificate of Deposit (CD) is a low-risk investment option that enables you to earn a higher interest rate than a standard savings account while ensuring your funds remain safe for a fixed period of time. The CD comes with a variety of terms and interest repayment options based on your financial goals and risk tolerance. With a minimum balance of $1,000 ($100 for ages 17 and younger), CDs are an excellent option for those seeking a reliable way to grow their savings.

Investing

Investing in stocks, bonds, and mutual funds can be a powerful tool in building your wealth and reaching your financial goals. But with so many options and factors to consider, it's important to have a clear understanding of each investment type and how they align with your unique circumstances.

Stocks: Owning a Piece of the Action

When you invest in stocks, you're essentially becoming a partial owner of a company. By purchasing shares, you have the opportunity to benefit from the company's growth and profitability. Stocks offer the potential for capital appreciation and may also pay dividends to shareholders. However, it's important to keep in mind that stock prices can be volatile and influenced by various factors such as market conditions and company performance.

Bonds: The Steady Income Option

Bonds, on the other hand, are debt instruments. When you invest in bonds, you're essentially lending money to a government, municipality, or corporation. In return, you receive regular interest payments and the repayment of the principal amount at maturity. Bonds are generally considered less risky than stocks and offer a more predictable income stream. However, they are still subject to risks such as interest rate changes and credit risk.

Mutual Funds: Diversification Made Easy

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of securities. They are managed by professional fund managers who make investment decisions on behalf of the investors. Mutual funds offer diversification, as they spread investments across a variety of stocks, bonds, or a combination of both. They are available in different types, catering to various investment objectives and risk profiles.

Benefits of Stocks, Bonds, and Mutual Funds:

- Stocks provide potential for long-term company growth and ownership.

- Bonds offer regular income and relative stability.

- Mutual funds provide diversification, professional management, and accessibility for individual investors.

Factors To Consider:

When it comes to investing, there are several key factors to consider that can guide you toward making informed decisions.

- Risk Tolerance: Your risk tolerance plays a crucial role in determining the right mix of investments for your portfolio. Are you comfortable with the potential ups and downs of the stock market, or do you prefer more stable and predictable returns? Understanding your risk tolerance will help you strike the right balance between potential gains and potential losses.

- Time Horizon: Consider your investment time frame. Are you investing for the long term, such as retirement, or do you have shorter-term financial goals? The length of time you can commit to your investments will influence the choice between stocks, bonds, or a combination of both. Stocks tend to offer higher returns over the long term but can be more volatile in the short term, while bonds provide stability and income but with potentially lower returns.

- Diversification: The saying "don't put all your eggs in one basket" holds true in investing. Diversification involves spreading your investments across different asset classes, such as stocks, bonds, and other investment vehicles. By diversifying, you can reduce the risk associated with any single investment and potentially enhance your overall returns. It's like building a well-rounded portfolio that can weather market fluctuations.

Once you've considered these key factors, it's time to explore the options available to you. Investment apps like Robinhood, Stash, and TradeStation offer accessible entry points for beginners or those with limited funds. However, it's important to exercise caution. These apps often gamify the stock market experience, which can lead to impulsive and riskier trades. Before sharing any sensitive information or making investment decisions, conduct thorough due diligence and research the credibility of the app.

To navigate the world of investing effectively, it's always wise to conduct thorough research and, if needed, seek guidance from a financial advisor. They can provide personalized advice and help tailor your investment strategy to your specific circumstances. Remember, investing is a journey, and your strategy should align with your financial goals and risk tolerance.

Investing in Your Retirement

Investing in your retirement is an essential part of achieving financial health. Retirement funds such as traditional and Roth 401(k) and IRA plans are designed to tap into the potential of the stock market. These funds offer a reliable and secure path toward building a robust retirement nest egg. That's why it's highly recommended to contribute as much as possible to your 401(k) or IRA, and if you can, max out your contributions before exploring other investment avenues.

By investing in the stock market through retirement funds, you harness the potential for growth and maximize your long-term returns. While it's essential to balance your investment strategy and diversify your portfolio, the stock market provides an opportunity to participate in the success of various companies and industries.

Remember, investing is a long-term game. It's about playing the odds and staying committed to your financial goals. By harnessing the power of the stock market through retirement funds, you can steadily grow your wealth and create a solid foundation for the retirement you've always dreamed of.

So, whether you're just starting your career or already on the path to retirement, make investing in the stock market a priority. Take advantage of retirement funds, contribute consistently, and watch your money work for you. It's a smart move that will pay dividends in the future and help you achieve the financial freedom you deserve.

Debt Management

Navigating the unpredictable waters of debt can be a challenge, even for the most financially responsible individuals. Life has a way of throwing curveballs that can leave us vulnerable to debt. But with our guidance, you can take control of your finances and steer towards a stable financial future.

Understanding the Types of Debt

Not all debts are created equal. Some debts can actually work in your favor, while others can wreak havoc on your financial well-being. Let's delve into the distinction between "good debt" and "bad debt."

- Good Debt: This type of debt is an investment in yourself or something that appreciates in value over time. Examples include student loans, which can enhance your earning potential, or a mortgage that allows you to build equity in a home. Even certain investments can fall into the category of good debt, as they have the potential to grow and increase your net worth.

- Bad Debt: On the other hand, bad debt refers to borrowing for expenses that lead to financial losses. Think of credit card purchases for non-essential items like clothes or dining out, or payday loans that come with exorbitant interest rates. Auto loans can be a gray area, as cars tend to depreciate quickly. They can be considered bad debt if the value of the vehicle decreases rapidly.

Differentiating good and bad debt boils down to whether the investment appreciates or depreciates in value over time.

The Impact of Debt on Financial Stability

Even if your debt falls under the category of "good debt," it can still become a burden if you're unable to make timely payments. Debt can quickly spiral out of control, leading to financial stress and potential long-term consequences. It's crucial to take proactive steps to manage your debt and maintain your financial stability.

Debt Strategies

If you're feeling overwhelmed by your debt and are looking for effective ways to regain control of your financial situation, there are several strategies you can consider.

- Debt Snowball Method: This method involves starting small and working your way up. Begin by paying off your smallest debt first, then take the amount you were paying for that debt and apply it towards the next smallest debt, and continue this process until all your debts are paid off. It provides a sense of accomplishment and motivation as you eliminate debts one by one.

- Debt Avalanche Method: Similar to an avalanche, this method focuses on tackling high-interest debts first. Start by paying off the debt with the highest interest rate, then redirect those funds towards the next highest interest rate debt, and continue until all debts are cleared. By prioritizing high-interest debts, you minimize the overall interest you'll pay.

- Debt Management Plan: If you need professional assistance, a debt management plan offered by a non-profit or credit counseling agency can be a valuable option. With this plan, your counselor negotiates with your lenders to potentially reduce interest rates or waive fees. You'll make a single payment to the agency, and they'll handle distributing the funds to your creditors, providing you with a structured approach to pay off your debts.

- Debt Consolidation: Consolidating your debts allows you to combine multiple debts into a single payment. This is achieved by taking out a new loan, ideally with a lower interest rate, to pay off your existing debts. While it simplifies repayment, be cautious and evaluate the terms carefully, as it could extend your debt repayment timeline and potentially result in paying more interest in the long run.

Pro Tip: To gain further insights and create a customized debt repayment plan, City & County Credit Union can be a valuable resource. Our trusted team offers personalized guidance to help you explore debt management strategies in more detail, giving you the support you need to achieve your goals.

Tips To Get Out of Debt

In addition to the major strategies mentioned earlier, there are several adjustments you can make to your debt approach and daily spending habits that can have a significant impact on your journey to becoming debt-free.

- Reduce Expenses: One of the simplest and most effective steps you can take is to immediately cut back on non-essential spending. By prioritizing essential expenses and eliminating unnecessary purchases, you can prevent your debt from growing further. Consider short-term solutions such as subletting your apartment or renting out a room in your home to generate additional income until you regain control of your debt.

- Pay More Than Your Minimum Balance: Even a small increase in your monthly payment can make a significant difference in paying off your debt sooner and reducing the overall amount you'll pay. By allocating extra funds towards your debt, you can accelerate your progress and save money on interest. Utilize the Debt Payoff Calculator below to see how these additional payments can impact your debt repayment journey.

- Negotiate With Your Creditors: If you're struggling to meet your minimum payments, it's worth reaching out to your creditors to discuss potential alternatives. You can request to modify the terms of your credit agreements to make the bills more manageable. While this may result in a longer repayment period and increased interest, it's often a better solution than defaulting or declaring bankruptcy. Open communication with your creditors can lead to mutually beneficial arrangements.

- Utilize Debt Counseling Services: Non-profit credit counseling services can provide invaluable assistance in dealing with creditors and finding the best strategies to handle your debts. These services often charge a reasonable fee and work with you to develop a practical repayment plan. The National Foundation for Credit Counseling (NFCC) is a reputable resource where you can find reliable counseling services.

It's essential to be cautious of debt counseling services that demand upfront fees without promoting changes to your spending habits. Dishonest organizations take advantage of vulnerable individuals by offering unrealistic, quick-fix solutions. Remember, true progress requires a combination of responsible financial practices and realistic repayment strategies.

Relying on Other Resources?

If you're struggling to make debt payments, it may be tempting to dip into your retirement savings plan at work. While borrowing from your 401(k) or similar plan can provide temporary relief, it's not a long-term solution and should only be done after careful consideration. Remember that you'll still need income from your savings later on in life.

If you do decide to borrow from your retirement funds, you can repay the amount you've borrowed on a gradual basis through payroll deductions, with the interest you pay going into your account. However, withdrawing from your retirement funds instead of borrowing from them will incur penalties, so it's important to be aware of the risks.

Another option to consider is a home equity loan to pay off debt. However, this type of borrowing puts your home at risk if you default, so it's important to proceed with caution. It's also harder to find such loans today since they contributed to the housing crisis.

One of the best ways to prepare for financial emergencies is to establish an emergency fund as part of your savings plan. Aim to set aside enough money to cover at least three to six months of living expenses, so that you have a cushion to fall back on in case of an unforeseen event.

Retirement Planning

Whether you've just landed your first job or you're well into your career, it's never too early to start thinking about retirement. It's a reality we all face—supporting ourselves for the 30 or 40 years after we retire requires a reliable source of income that goes beyond Social Security or lucky lottery wins.

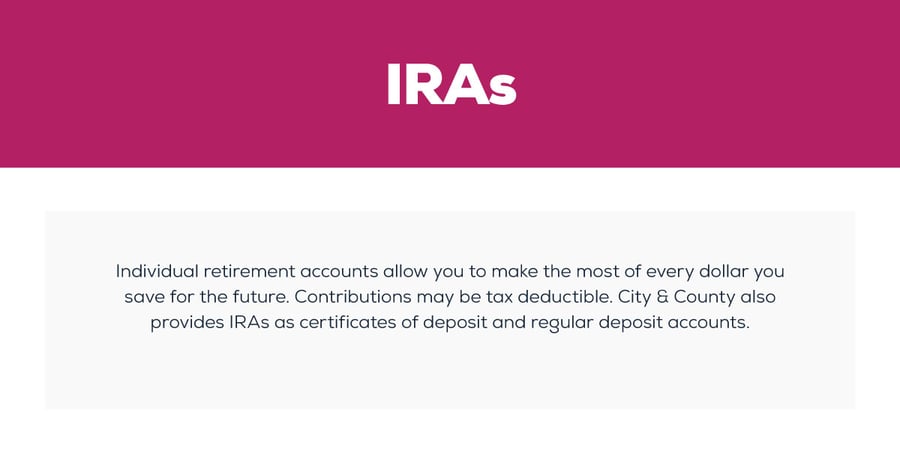

When it comes to planning for retirement, there are two main types of accounts to consider: Individual Retirement Accounts (IRAs) and 401(k)s. While both provide a means to save for the future, they differ in terms of accessibility, employer involvement, and taxation. Let's delve into the details to help you make informed decisions about your retirement savings.

Understanding 401(k)s and IRAs

Unlike a standard savings account, funds in a 401(k) or IRA are invested in various assets such as stocks, bonds, and mutual funds. This investment approach has the potential to accelerate the growth of your retirement funds. By leveraging the power of the market, you can build a robust nest egg that can support you during your retirement years.

The main distinction between 401(k)s and IRAs lies in their origins. A 401(k) is an employer-provided retirement account, while an IRA is an individual account opened at a financial institution. Some employers offer a valuable perk: matching contributions to your 401(k). This means that your employer will contribute a percentage of your salary to your retirement fund, effectively giving you free money to enhance your savings.

Navigating Contribution Limits

The IRS sets annual contribution limits for retirement accounts to ensure fairness and provide guidelines for individuals' savings efforts. In 2023, the maximum contribution to a 401(k) is $22,500. This allows you to allocate a substantial portion of your income toward your retirement goals. On the other hand, IRAs offer greater flexibility, allowing you to open an account at any time. The contribution limit for an IRA is set at $6,500 per individual. It's worth noting that you can have both an IRA and a 401(k) simultaneously, maximizing your potential to save for retirement.

Navigating Taxation Considerations

Retirement accounts are subject to different tax treatments, which can significantly impact your overall savings. The two primary methods of taxation for retirement funds are Traditional and Roth accounts.

With a Traditional account, the money you contribute is not taxed until you withdraw it in retirement. This means that your tax obligations are deferred until your retirement years, allowing your funds to potentially grow uninterrupted.

In contrast, Roth accounts involve contributing after-tax money. The advantage of a Roth account is that qualified withdrawals in retirement are tax-free. This provides greater certainty about the tax implications during your retirement years and ensures that the funds you withdraw are entirely yours.

Choosing between Traditional and Roth accounts depends on your unique financial situation and expectations for the future. Consider consulting with a financial advisor to assess the tax implications and make informed decisions.

As you navigate the realm of retirement savings, understanding the potential of 401(k)s and IRAs is crucial. Assess your goals, evaluate employer offerings, explore contribution limits, and consider taxation considerations to tailor a strategy that aligns with your long-term financial well-being. Remember, planning for retirement requires a comprehensive approach, and seeking professional guidance can help you optimize your savings journey.

The Importance of Starting Early: Supercharging Your Retirement Account

When it comes to retirement planning, time is undeniably your greatest ally. Starting your retirement account as early as possible can have a transformative impact on your financial future. Why? The power of compounding. By investing your funds early and consistently, you give them the opportunity to grow exponentially over time.

Even modest contributions made in your twenties or thirties can potentially snowball into a substantial nest egg by the time you retire. This is because your earnings not only accumulate, but they also generate additional earnings. It's a compounding effect that can significantly supercharge your retirement savings.

By starting early, you can take advantage of the longer investment horizon, weather market fluctuations, and potentially benefit from the higher returns associated with long-term investments. So, don't underestimate the power of time.

Embrace the opportunity to set the stage for a secure and comfortable retirement by kick-starting your retirement account as early as possible. Your future self will thank you.

Financial Wellness Resources

At City & County Credit Union, we're committed to supporting your financial well-being beyond budgeting apps. We offer a range of additional resources and tools designed to empower you on your journey to financial success.

Financial Coaching and Education Programs

We understand that managing your finances can sometimes feel overwhelming, and that's why we provide access to personalized financial coaching and educational programs. Through our partnership with GreenPath Financial Wellness, a non-profit educational resource, CCCU members can take advantage of free counseling sessions facilitated by expert financial counselors dedicated to helping you achieve your financial goals.

GreenPath covers a wide array of counseling topics to address your specific needs:

- Budget Counseling: Work with a counselor to create a realistic budget that aligns with your income and expenses. Learn valuable strategies to track your spending, reduce debt, and save for the future.

- Debt Management Plan: If you're struggling with overwhelming debt, GreenPath can guide you through the process of creating a debt management plan. They'll help you negotiate with creditors, consolidate payments, and establish a roadmap to become debt-free.

- Credit Report Review: Understand the ins and outs of your credit report and learn how to improve your credit score. GreenPath counselors will provide insights on managing credit responsibly and building a strong credit history.

- Mortgage Counseling: Are you considering homeownership or facing challenges with your current mortgage? GreenPath offers counseling sessions to help you navigate the complexities of mortgages, understand your options, and make informed decisions.

- Student Loan Counseling: If student loans are a significant part of your financial picture, GreenPath can assist you in understanding your repayment options, exploring loan forgiveness programs, and developing a plan to manage your student loan debt effectively.

- Financial Wellness: GreenPath counselors are equipped to address a wide range of financial topics, including retirement planning, investment strategies, and building emergency funds. They will provide guidance and resources to enhance your overall financial wellness.

Getting Started With CCCU's Financial Wellness Resources

Embarking on your financial wellness journey with City & County Credit Union is simple. As a member, you already have access to these valuable resources. To begin, reach out to CCCU and inquire about scheduling a counseling session with GreenPath. Our friendly staff will guide you through the process and ensure you're connected with the support you need.

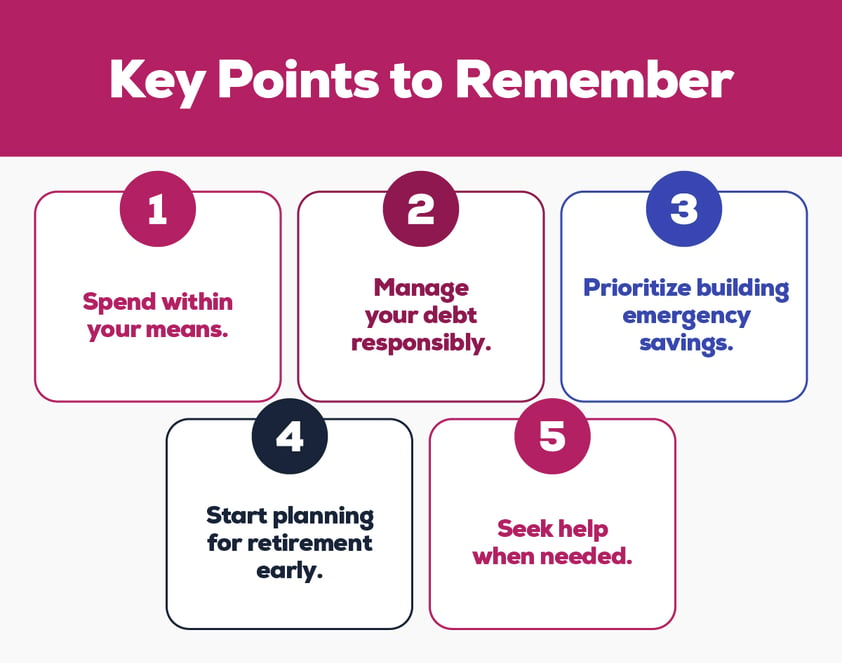

Healthy Financial Habits

If you often find yourself overwhelmed by your financial situation, rest assured that you are not alone. Nearly half of all Americans struggle to cover their bills or save for the future, living paycheck to paycheck. However, by adopting some important financial habits, you can gain confidence and improve your financial well-being.

How Can You Tell If You're Financially Fit?

Financially fit individuals share certain characteristics, according to experts. These include:

- Earning Enough to Cover Expenses: Ensure that your weekly and monthly earnings are sufficient to cover your financial obligations.

- Managing Debt: Strive to be debt-free or maintain a manageable amount of debt.

- Confident About the Future: Feel a sense of confidence and security regarding your financial future.

- Balanced Spending: Spend money on things that bring you joy without worrying about paying bills.

- Building Emergency Savings: Have a safety net in the form of emergency savings for unexpected expenses.

- Retirement Planning: Save enough to comfortably retire at the desired age.

- Excellent Credit: Maintain a great or excellent credit score.

Whether you consider yourself financially fit or believe there's room for improvement, adopting these key habits can pave the way to becoming more financially secure and achieving your goals.

Live Within Your Means

Living within your means is the cornerstone of financial well-being. It means that your monthly expenses should not exceed your net monthly income (the amount you earn after taxes). By living within your means, you can avoid debt and start saving for the future. To determine if you're living within your means, track your spending and ensure it aligns with your income.

Spend Wisely

Evaluating your spending habits is crucial. One simple rule to follow is the 50-30-20 rule, which suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings or debt payments. This balanced approach helps prioritize essential expenses while leaving room for personal enjoyment and savings.

Free Up Funds To Cover Expenses

If you find it challenging to cover your expenses, consider implementing these creative ideas to free up funds:

- Reduce Expenses: Start by cutting unnecessary expenses, such as eating out or going to the movies. Look for ways to save on groceries and compare insurance rates to lower costs.

- Explore Earnings Potential: Assess your current employment status and explore opportunities for career advancement or increased income.

- Second Source of Income: Consider taking on a second job or exploring gig economy opportunities to supplement your earnings.

- Sell Unused Items: Clear out clutter and sell items you no longer need. Online platforms or garage sales can help you turn unwanted items into extra funds.

Build Emergency Savings

While covering your monthly expenses is essential, building emergency savings is equally crucial. Unexpected situations such as car repairs, job loss, or medical bills can impact your financial stability.

Avoid Excessive Debt

Debt can be a burden if not managed properly. While it's common to have debt, it's crucial to keep it at a manageable level. Consider these strategies to handle your existing debt:

- Downsize: Assess your lifestyle choices and downsize if necessary. Avoid living beyond your means by making affordable housing, transportation, and daily expense choices.

- Negotiate with Creditors: Take the initiative to negotiate with your creditors for lower interest rates, reducing the cost of your debt.

- Consolidate Debt: If you have multiple debts, consider consolidating them into a single loan with lower interest or more manageable monthly payments.

Save for Retirement

Saving for retirement is essential for long-term financial stability. Start planning early and follow these steps:

- Explore Retirement Account Options: If your employer doesn't offer retirement benefits, contact CCCU or an investment company to explore retirement account options that suit your needs.

- Take Advantage of Employer Contributions: If your employer offers matching contributions, contribute the maximum amount to make the most of this free money.

- Harness the Power of Compound Interest: The earlier you start saving, the more time your money has to earn compound interest. Even small contributions can make a significant impact over time.

Know When To Get Help

If you find yourself struggling despite your best efforts, don't hesitate to seek assistance. Consider these resources:

- Contact CCCU: Reach out to CCCU's representatives for assistance or guidance. We can provide support or recommend other resources if necessary.

- Financial Counseling Association of America: Visit the organization's website to access professional financial counseling services.

- National Foundation for Credit Counseling: Seek a certified credit counselor for personalized assistance in managing your financial situation.

- Legal Assistance: If you're dealing with overwhelming debt, consult with a reputable attorney specializing in debt settlement.

City & County Credit Union is dedicated to supporting your financial well-being. By adopting these healthy financial habits and leveraging the resources available, you can achieve financial fitness and secure a brighter future.

How CCCU Can Help

Financial wellness is not just about money—it's a cornerstone of a happy and fulfilling life. It empowers you to take control of your finances, achieve your goals, and pave the way for a brighter future.

At City & County Credit Union, we recognize the significance of financial wellness and the pivotal role we play in helping our members achieve it. As a member-owned, not-for-profit financial institution, our primary focus is on our members' well-being. We are dedicated to giving back to our members and community by providing valuable financial resources, expert guidance, and more. With CCCU as your trusted partner, your journey toward financial empowerment begins on a solid foundation.

Classes & Workshops

Join us for our informative and engaging classes and workshops, either in-person or via webinar. Our experts at City & County Credit Union will guide you through important money topics such as budgeting, credit scores, and the home-buying process. Each class is designed to empower you with knowledge and help you create an action plan to achieve your financial goals. We understand that everyone's financial journey is unique, and our classes cater to different levels of expertise and experience.

Blog

Our blog is a treasure trove of insights, practical tips, and effective strategies to take charge of your finances. We cover a wide range of topics, including budgeting, saving, investing, managing debt, and more. Whether you're a financial novice or an experienced saver, our blog provides valuable information that you can easily apply to your financial life. You can search for articles by topic to find exactly the help you are looking for, making it a convenient resource at your fingertips.

CCCU: More Than Just a Credit Union

City & County Credit Union is more than just a financial institution. We are your trusted partner on the journey to financial wellness. With our member-centric approach and dedication to giving back to our community, we go above and beyond to provide you with the resources and guidance you need to achieve your financial goals.

Take the first step towards financial empowerment today and explore the wealth of information available at CCCU. Together, we can build a brighter financial future for you and your loved ones.

Download

Want to snag a PDF copy of this content? Simply fill out the form below, and it's all yours!