Picture this: It's a crisp Minnesota morning, and you're sipping your coffee, scrolling through your phone. Suddenly, you see it — your tax refund has hit your account. But instead of a tiny trickle, it's a satisfying stream. Sounds too good to be true? Not if you play your cards right.

Here at City & County Credit Union, we've seen members turn their tax returns from a yearly headache into a financial highlight. It's not about magical thinking or risky moves — it's about smart strategies and knowing the lay of the land.

Whether you want to boost your emergency fund, tackle a home project, or keep more of your hard-earned cash, we’ve got you covered. Let's look at some practical, powerful ways to make your tax return work harder for you.

1. Claim All Eligible Deductions

Think of deductions as your financial best friends. The standard deduction is great for many, but if you've had a year of big changes (hello, home office or major medical bills), itemizing could be your ticket to savings.

Think of deductions as your financial best friends. The standard deduction is great for many, but if you've had a year of big changes (hello, home office or major medical bills), itemizing could be your ticket to savings.

Don’t forget the little things — those charitable donations and volunteer miles can add up fast. Make sure to keep accurate records throughout the year so you can maximize your deductions come tax time.

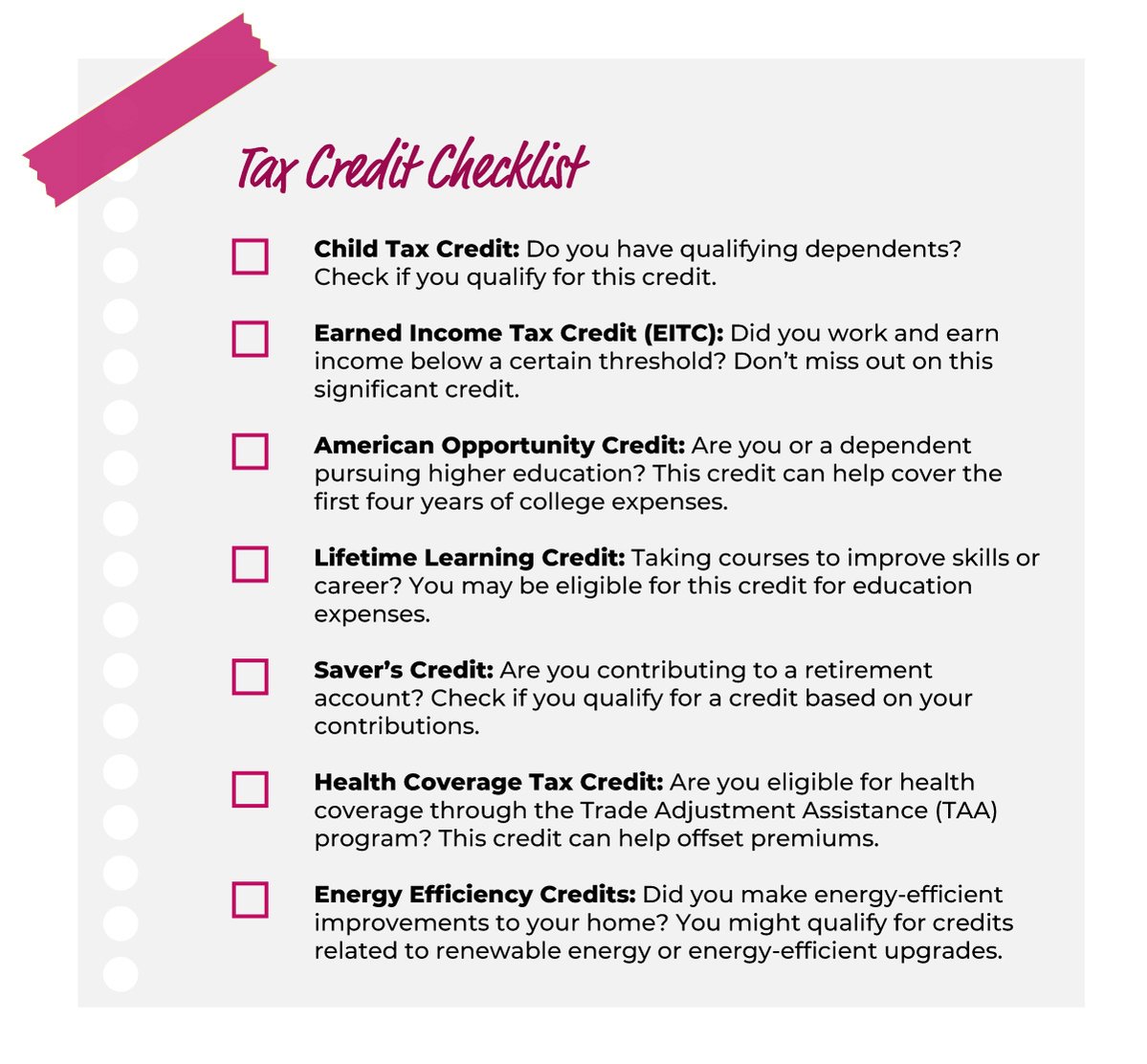

2. Maximize Tax Credits

If deductions are good, tax credits are the real MVPs of the tax world. They slash your tax bill dollar for dollar. From child tax credits to education perks, there's a whole playbook of options. Some credits fly under the radar but pack a serious punch — for example, the Earned Income Tax Credit (EITC) can significantly boost your refund if you qualify.

Research all available credits and ensure you meet the eligibility requirements to take full advantage.

3. Optimize Your Retirement Contributions

Saving for retirement isn't just a future you problem — it's a smart move for the present you, too. Maxing out your 401(k) or IRA could mean a lighter tax load now and a cozier future later. If you contribute to a traditional IRA, you may be able to deduct those contributions from your taxable income.

And if you're 50 or up? You've got extra room to catch up and save, so make sure to take advantage of those higher contribution limits.

4. Leverage Health Savings Accounts (HSAs)

HSAs are the secret weapon of tax-savvy folks. If you've got a high-deductible health plan, these accounts offer a triple tax benefit that's hard to beat: Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free.

HSAs are the secret weapon of tax-savvy folks. If you've got a high-deductible health plan, these accounts offer a triple tax benefit that's hard to beat: Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free.

It's like getting a hall pass on taxes for your healthcare costs. Plus, HSAs can be invested for potential growth, making them an even smarter financial tool.

5. Time Your Income and Expenses

Sometimes, it's not just about how much you earn or spend — it's about when. A little strategic thinking in December could mean a much happier April 15th. Here are some timing tricks to try:

- Push that year-end bonus to January to lower this year's taxable income

- Make big charitable donations before December 31st for current-year deductions

- Pay January's mortgage payment in December for extra interest deductions

- Hold off on selling investments with gains until the new year if you're close to a higher tax bracket

It's like timing the perfect cannonball into the pool — get it right, and you'll make a big splash (in your savings).

6. Explore Self-Employment Tax Breaks

Being your own boss has its perks, including some nice tax advantages. Your home office could be a real game-changer for your taxes. You can deduct expenses like internet bills, office supplies, and even a portion of your home costs if you use a specific area exclusively for business. This can add up to significant savings at tax time!

Being your own boss has its perks, including some nice tax advantages. Your home office could be a real game-changer for your taxes. You can deduct expenses like internet bills, office supplies, and even a portion of your home costs if you use a specific area exclusively for business. This can add up to significant savings at tax time!

7. Consider Professional Tax Help

Sometimes, calling in the pros is the smartest move you can make. A good tax expert can spot opportunities you might miss and help you avoid costly missteps.

They can guide you through the complexities of tax laws and maximize your return. Think of it as an investment in your financial peace of mind.

Next Steps: Implementing Your Tax Refund Strategy

The best time to start thinking about next year's taxes isn't April 16th — it's now. A year-round approach can turn tax season from a dreaded chore into a financial win you actually look forward to.

At City & County Credit Union, we're not just number crunchers. We're your partners in building a brighter financial future. Our investment team brings over 70 years of know-how to the table. Whether you're planning for retirement, saving for your kid's college fund, or just trying to make sense of the tax code, we've got your back.

Ready to take your tax strategy from good to great? Don't go at it alone. Our investment team is ready to help you craft a personalized plan that fits your unique financial goals like a glove.

Disclaimer: This blog post is for informational purposes only and should not be construed as tax advice. Please consult with a qualified tax professional to discuss your specific tax situation.