Close your eyes and picture your child walking across the stage to receive their diploma, smiling with pride and confidence. That’s what every parent wants for their child, right?

But there’s a catch. To get there, your child will need a quality education — and that comes with a hefty price tag. According to EducationData.org, the average cost of college in the United States is $35,551 per student per year, including books, supplies, and daily living expenses.

How can you afford to send your child to college without burning a hole in your wallet or drowning in debt? How much should you save, and how should you save it? CCCU is here to help!

Whether you have a newborn or a high school senior, it’s never too early or too late to start planning for a college education. With the following tips and tricks in mind, you can turn your dreams into a reality and give your child the best gift possible: a bright future!

Key Considerations for Financing a College Education

Saving for college is not a one-size-fits-all affair. You have to think about where your child wants to go, what they want to study, and how much it will cost. And one of the most significant cost factors is the type of school: in-state or out-of-state, public or private.

wants to go, what they want to study, and how much it will cost. And one of the most significant cost factors is the type of school: in-state or out-of-state, public or private.

Each option has its own advantages and disadvantages. In-state tuition can save you a bundle, but it may limit your child’s options. And while private schools often have a higher price tag, they may offer more scholarships and financial aid options.

With so many variables in play, it's important to do your research and weigh the pros and cons before deciding on the best approach for your family's finances.

College Savings Strategies

Saving for college can seem like a daunting task, but you don’t have to do it all by yourself. There are some smart ways to save that can help you reach your goals and give your child a bright future.

Whether it’s taking advantage of tax benefits, finding alternative sources of funding, or maximizing your returns, these strategies can help you grow your savings and ensure that your child has the means to pursue their passions.

The 3x Rule

When it comes to saving for your child's college education, it's important to set realistic goals from the get-go. And one helpful starting point is the 3x rule. This rule of thumb suggests that you should aim to save three times the cost of a four-year college education when your child is born, accounting for the average inflation rate of college costs over time.

The 1/3 Rule

The "1/3 rule" is a popular college savings strategy that aims to help families and students plan and save for the high cost of higher education. With this rule, one-third of the total cost of college should be covered by the student's own resources, such as scholarships, grants, and earnings from work-study or part-time jobs. Another third should come from parent or family contributions, and the final third should come from student loans or other forms of financial aid.

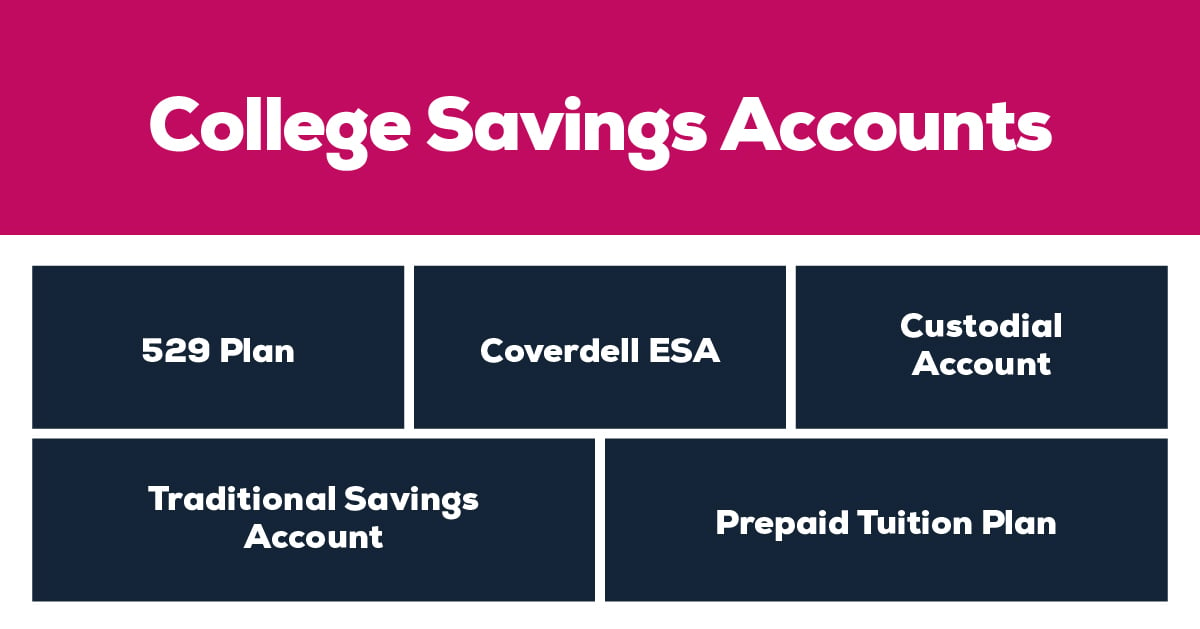

Types of College Savings Accounts

Now that we've covered some college savings strategies, let's take a look at some of the different types of college savings accounts that can help you achieve these goals!

529 Plan

A 529 college savings account is a tax-advantaged investment account designed specifically for education expenses. When you contribute to a 529 account, your earnings grow tax-free, and withdrawals for qualified education expenses are also tax-free. This means you can save money on taxes while saving for your child's education.

Plus, many states offer additional tax benefits for contributions to 529 accounts. It's a smart choice for anyone looking to save for college without incurring unnecessary taxes or fees!

Coverdell Education Savings Account (ESA)

A Coverdell ESA is a special account that lets you save money for your child’s education tax-free. You can invest in stocks, bonds, or mutual funds for higher potential earnings than a traditional savings account.

However, there are limitations, such as a $2,000 annual contribution per child and income eligibility requirements. You must use the money before your child turns 30 or roll it over to another beneficiary.

Custodial Account

A custodial college savings account allows you to save money for your child’s education in their name. You can open this account at any financial institution and choose how to invest the money.

The advantage of this account is that it may qualify for lower taxes and financial aid than other types of accounts. The disadvantage is that you lose control over the money once your child reaches the age of majority (usually 18 or 21). At that point, they can use the money for any purpose, not just education.

Traditional Savings Account

A traditional savings account is a safe and reliable option for saving for college. It offers several benefits that make it ideal for long-term goals like education. Here are some of them:

- You can earn interest on your money and watch it grow over time.

- You can access your money anytime you need it, without penalties or fees.

- You can avoid market risks and fluctuations that can affect other types of investments.

- You can start with any amount and contribute as much as you want, whenever you want.

Prepaid Tuition Plan

A prepaid tuition plan is a clever investment in your child's future that lets you lock in today's tuition rates for future college expenses. It's like buying a "tuition voucher" that covers the cost of tuition and sometimes fees at participating colleges and universities.

These plans typically operate on a state-by-state basis, and they allow you to prepay for a set number of years of tuition at today's prices, ensuring that your child can afford the best education without being burdened by future inflation.

CCCU’s Scholarship Program

At City & County Credit Union, we don't just care about money — we care about people. We are deeply invested in our members, their children, and their dreams for the future. That's why we're proud to offer ten amazing scholarships of $1,000 every year to help local students achieve their academic goals.

are deeply invested in our members, their children, and their dreams for the future. That's why we're proud to offer ten amazing scholarships of $1,000 every year to help local students achieve their academic goals.

Whether pursuing a degree in engineering or education, art or architecture, we believe that everyone deserves the chance to succeed — and we’re here to help make it happen!

Think Pink

As a parent, you want the best for your child — and that includes a bright future filled with opportunities. That's why it's never too early to start planning for their education, and City & County Credit Union is here to help.

Whether your child wants to go to college, trade school, or any other type of higher education, we have a range of savings and investment solutions that suit your budget and your vision. And with our friendly financial advisors and tailored advice, you can rest assured that you're on the right track for your family's future.