Cash-back debit cards sound almost too good to be true, don't they? The idea of earning cold hard cash simply by using your debit card for everyday purchases seems mysterious. How can swiping your card result in actual money back in your pocket? What's the catch?

We know — cash-back debit cards can seem complicated at first. But don't worry! Here at City & County Credit Union, we want to explain how they work. That way, you can decide if earning cash back fits your financial plan.

In this blog, we'll explain exactly how cash-back debit cards work so you can feel informed and empowered. We'll break down the basics in a way that makes good financial sense. No secrets, no small print, no mysteries. Just helpful guidance from your trusted credit union.

What Are Cash-Back Debit Cards?

Cash-back debit cards function like your regular old debit card with one exciting twist — they pay you back! Each time you use your cash-back debit card to make a purchase, you'll earn cash rewards based on the dollar amount. It's like getting a slice of your money back, just for spending as you normally would.

Let's break this down with an example. Imagine you're at the grocery store and your total rings up to $100. If your cash-back debit card offers 2% back, you would earn $2 in rewards on that $100 grocery haul! Now just picture those cash rewards accumulating each time you swipe your card. Over weeks, months, and years, that "free money" can really add up.

Unlike credit card rewards programs, cash-back debit cards don't require you to rack up interest charges or revolving debt. The cash comes directly back to you just for using the card tied to your checking account. It's an effortless way to earn extra cushion as you go about your regular spending.

How Do Cash-Back Debit Cards Work?

The cash-back rewards process is surprisingly simple. It all comes down to the cash-back rate your card provides. Typically this ranges from 1-2% of your total purchases, but some cards amp up the rewards in specific spending categories.

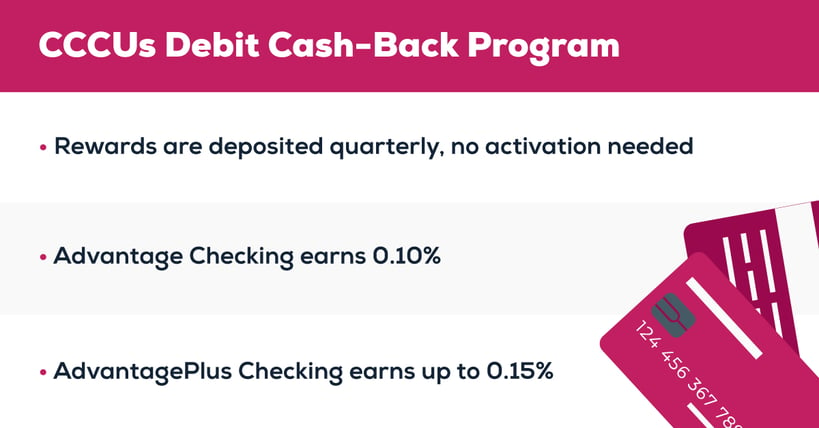

As you use your card, the cash-back earnings are automatically tracked and tallied up. Then, on a monthly or quarterly basis, the rewards are deposited into your checking account. It's the most convenient way to steadily grow your money a little at a time as you handle everyday spending!

City & County Credit Union's Debit Cash-Back Program

At City & County Credit Union, we want your hard-earned money to work as hard for you as you do for it. That's why we created our debit cash-back rewards program—to help members like you earn a little extra just for everyday spending.

Whether it's picking up groceries, grabbing your morning coffee, or paying the bills, those small, everyday debit card transactions accumulate into steady cash rewards over time.

We designed our debit cash-back program to help CCCU members effortlessly keep more of their hard-earned money. Because at the end of the day, we believe your money should stay where it belongs — in your pockets!