It’s true – fraudsters are out there & are always searching for their next target! The good news is that you have the power to keep them out of your digital finances! It’s all about taking a few extra steps to boost your personal security and keep your hard-earned money right where it belongs — with you!

Recognize the Threats

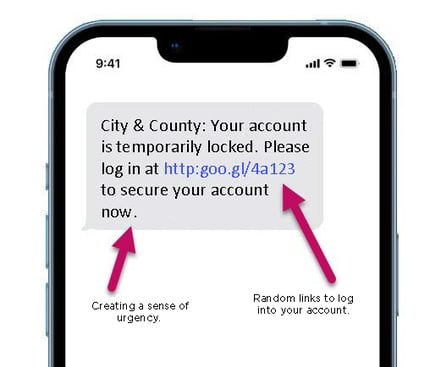

Understanding and recognizing threats is an important part of keeping your accounts safe. Threats can come from various sources, such as emails, phone calls or texts.

Look out for warning signs like unsolicited messages requesting account information or calls alerting you of fake fraudulent activity. These messages often come with a sense of urgency, claiming there's a problem that needs immediate fixing. In these situations, never share your account details or grant access in response to these communications. The best way to verify if they are real or fraudulent is by getting in touch with your credit union. Learn more about how to spot & avoid scam phone calls here!

Remember, City & County Credit Union will never ask for sensitive information like your social security number, passcodes & account PIN by phone call, text or email. Being aware of these common scams can help fight against fraudsters and keep your accounts safe and sound.

Secure Your Accounts

Start by using strong, unique passwords and enabling two-factor authentication for added protection. Using a combination of uppercase letters, lowercase letters, symbols, & numbers can increase the security of your password. Avoid using easily guessable information like family names, birthdays or phone numbers.

Additionally, check out your City & County Mobile app where you can turn on account notifications and control your debit & credit card all from the app. This way, you will get alerts about any activity happening in your account and be able to turn on and off your cards at any time. Plus — regularly monitoring your account allows you to quickly report any suspicious activity, helping to maintain the security of your accounts.

Contact Us for Help

We are always here to support you through any worries you may have. Trust your instincts — if something feels off, it's worth reaching out to us. Whether you suspect fraudulent activity or simply have questions, don't hesitate to get in touch. Let's work together to keep your information secure!

Contact us immediately if you suspect any suspicious activity at (651) 225-2700.

.jpg)