Got those student loan blues? We feel you. Your hard-earned degree shouldn't mean sacrificing your monthly budget. If you're nodding along, wondering if there's a light at the end of this repayment tunnel, take heart — there is.

In this blog, we'll walk you through the ins and outs of student loan refinancing, helping you determine if it's the right move to save money and simplify your life.

What Is Student Loan Refinancing?

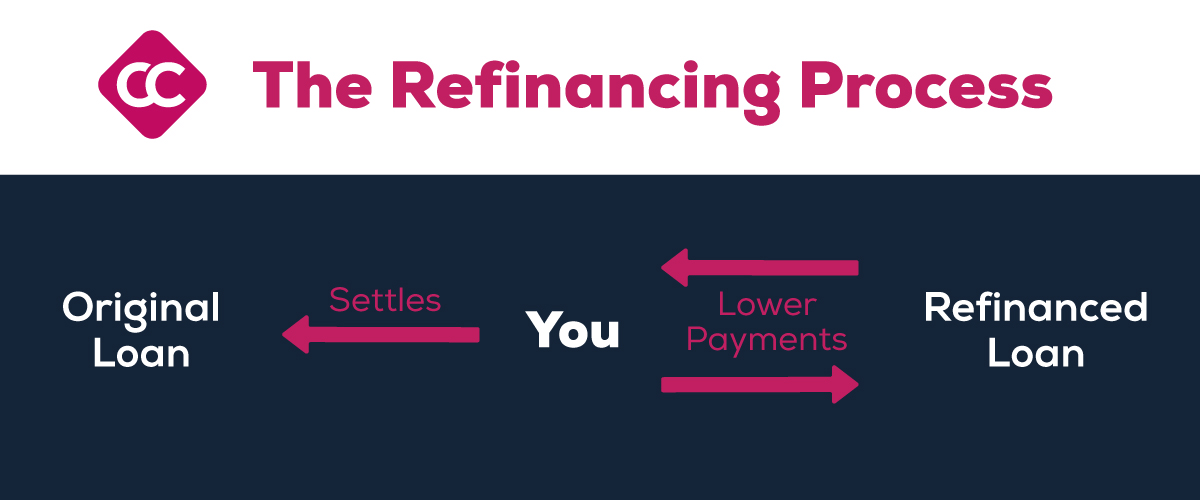

Refinancing student loans means taking out a new loan to pay off your existing loans. The goal is to secure better terms — like a lower interest rate — so you pay less over time. Even a small rate drop can save you thousands down the road!

Refinancing student loans means taking out a new loan to pay off your existing loans. The goal is to secure better terms — like a lower interest rate — so you pay less over time. Even a small rate drop can save you thousands down the road!

Refinancing is not for everyone, but it may be a smart move if you can qualify for better rates. The goal is to find the option that best fits your situation. While you don’t want to rush into it blindly, refinancing is something savvy graduates consider to ease their monthly burden.

Benefits of Student Loan Refinancing

If refinancing feels like the right move, be a smart shopper — compare all your options thoroughly first. Look at interest rates, fees, terms, perks, and customer service reviews. Finding the best fit takes some legwork, but it’s worth it!

What could you gain by refinancing? Here are some prime benefits to consider:

- Lower interest rates: Even a slight dip in your interest rate can translate to huge long-term savings. Imagine keeping more money in your pocket each month!

- Consolidated payments: Refinancing lets you streamline everything into one simple payment — ahhh, so much easier.

- Release of cosigner: If you no longer need a parental co-signer, refinancing can remove them from their obligation.

- Faster payoff: Switching from a longer repayment term to a shorter one helps you become debt-free sooner. The ultimate goal!

- Bigger tax deductions: Depending on your new loan details, you could qualify for better student loan interest deductions.

The key is weighing your unique situation — refinancing is like a custom-tailored suit, it works when it fits just right.

Is Now the Right Time?

While refinancing is appealing, timing is everything when it comes to maximizing those benefits. The best candidates are employed grads whose credit scores have improved since taking out their original loans, boosting eligibility for lower rates.

If your income is solid and you have good to excellent credit, it may be a smart move. But if your credit needs work or there's a chance you'd qualify for loan forgiveness, it could make more sense to hold off.

Our advice? Run a quick calculation to test the refinancing waters. You may be pleasantly surprised at the potential savings!

Refinance Your Student Loans With CCCU and Get a $300 Cash Bonus

If you've weighed the pros and cons and decided refinancing is your winning play, CCCU can make it happen fast and easy. Our simple online application lets you compare options and apply in just minutes from the comfort of your couch.

Here's what you can expect when you refinance with us:

Here's what you can expect when you refinance with us:

- Combine all loans into one manageable monthly bill

- Lock in low rates starting at just 4.24% APR — score!

- Snag a $300 cash bonus as our welcome gift to you

- Lean on our caring local team if you need guidance along the way

At CCCU, we're always on your side. We take the headache out of finances so you can focus on the good stuff. Give us a shot to save you money and simplify your life — you deserve it!