As a homeowner, you know that your house is more than just four walls — it's an investment. And sometimes, investments need a little TLC and cash flow to reach their full potential.

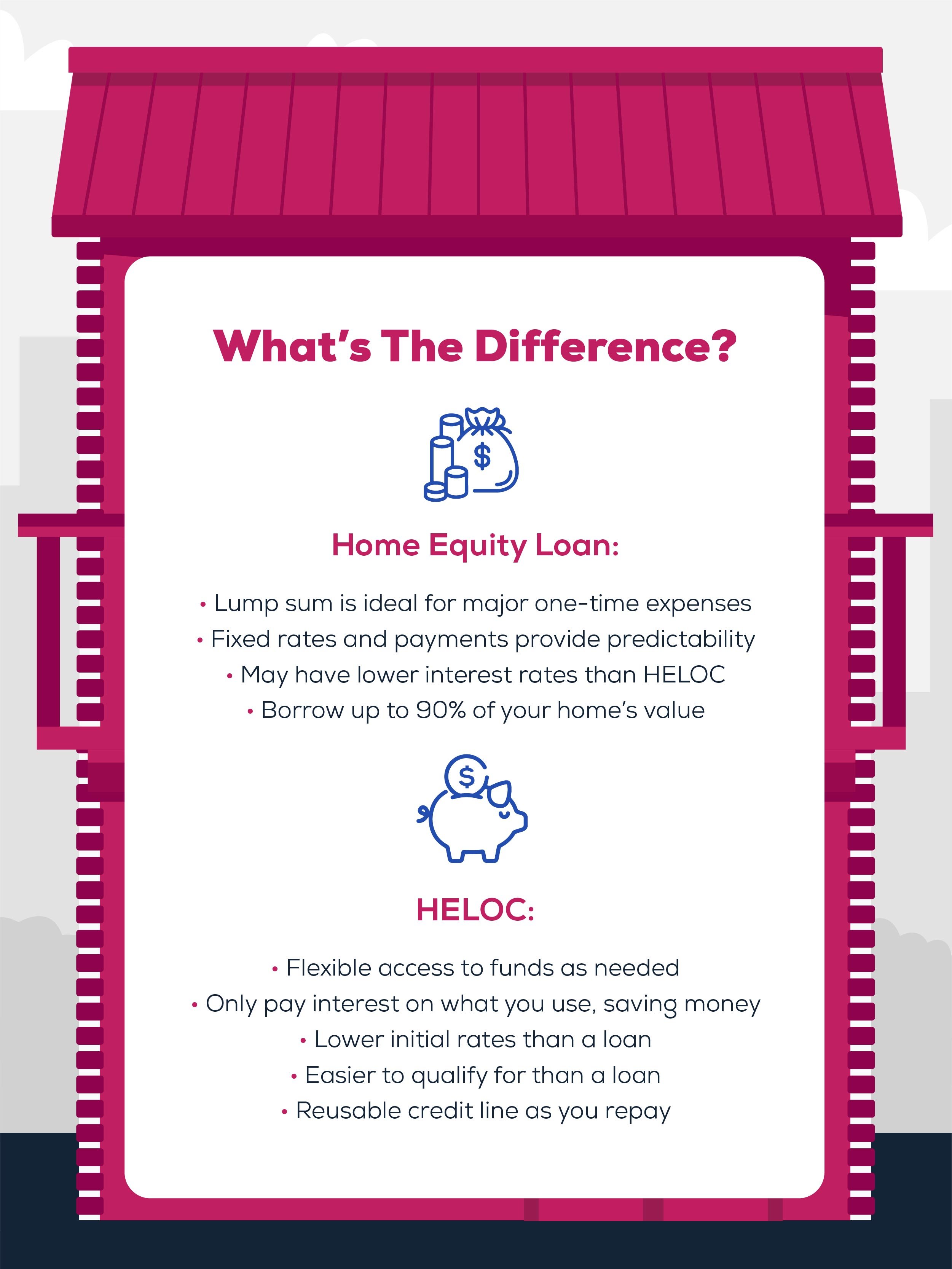

The big question is: should you open a home equity line of credit (HELOC) or take out a traditional home equity loan? Each has pros and cons.

In this blog, we'll walk through the key differences between the two. You'll learn when a HELOC makes more sense for your goals versus a home equity loan. With clear explanations, you can decide which option is best for your needs and budget!

What Is a Home Equity Loan?

If you're looking for a big chunk of cash to tackle a major expense, a home equity loan could be a great option. With a home equity loan, you borrow against the equity in your home—the current market value minus what you owe on your mortgage—to get an upfront, lump-sum payment.

The loan amount and interest rate stay the same over the full loan term, usually 5-30 years. You'll make the same monthly payment during that time until it's all paid off. Unlike other financing options, you get all the money at once to put toward your goal.

What Is a HELOC?

Think of a HELOC as a credit card for your home equity. With this flexible line of credit, you're approved to borrow up to a set limit — then you can access those funds as needed.

Unlike a cash-out refinance loan, you only tap the HELOC when required. Need to finance those new kitchen counters over time? Cover an unexpected medical bill? With a HELOC, the funds are there if and when you need them.

As you repay the balance, your available credit is replenished. This revolving access makes HELOCs useful for managing ongoing or unplanned costs. You only pay interest on the amount you actually borrow.

HELOCs have rates that vary, so your monthly payment goes up and down with the market. But when used carefully, the flexible, low-cost borrowing of a HELOC can open up more financial choices for you.

Key Differences Between a Home Equity Loan and a HELOC

Home equity loans and HELOCs have distinct benefits that make each option better suited for certain borrowing needs. When weighing your choices, be aware of these key differences between them:

As you can see, each product has unique benefits depending on your financial needs and goals. The key is choosing the right fit for your situation.

The CCCU Home Equity Edge

Dreaming up plans for your home? We have the financing to make it happen. At CCCU, our home equity loans and HELOCs provide the funding you need — whether it's for remodeling, debt consolidation, or home upgrades.

What makes our loans the best choice for homeowners?

For starters, we offer exclusive member-only discounts that you won't find with other lenders. Our low closing costs and flexible repayment terms add even more savings. And you'll never face prepayment penalties when paying off your loan early.

On top of great rates, we make the process quick and easy. Our experts guide you through fast, simple pre-approval so you can access funds swiftly. We'll give you personalized advice to find the perfect loan for your situation, no matter how you plan to use it.

Let's have a conversation about how we can simplify your path to financing. Together, we'll get you the funds to create your dream home oasis.