It's no secret that the internet is filled with conflicting information and never-ending noise offering financial advice. From clickbait articles to self-appointed experts, it can be tough to separate fact from fiction.

The truth is — there’s no one-size-fits-all answer to the question “how much money should I have saved by 30?” Everybody’s financial situation is unique to their own circumstance, but it’s never too early (or late) to start thinking about your financial future.

Saving money can help you achieve your goals and provide a sense of security, whether it's buying a house, starting a family, or investing in your future. Below are some of the most important factors to consider when planning a savings strategy, as well as some insider tips to get started!

Important Financial Factors to Consider

When it comes to saving money, there are hundreds of factors to consider. It’s not just about stashing money aside for a rainy day — though having an emergency fund is definitely important.

You need to think about your long-term financial goals, including retirement, debt repayment, and saving for those big-ticket items (like a house or car). And that’s just the beginning!

This may feel like an overwhelming process, but with the right tools and guidance, it’s possible to develop a savings plan that works for you. By focusing on your priorities and making smart choices, you can set yourself up for a financially secure future.

First Step: Focus on Emergency Funds

You probably already know that life is unpredictable and unexpected expenses can arise at any time. This is why it’s important to have at least three to six months’ worth of living expenses saved in a readily-accessible account.

An emergency fund provides a safety net for the unexpected, like losing a job, experiencing a medical emergency, or encountering a major unexpected expense. Not only will it provide peace of mind, but an emergency fund can help prevent you from going into debt or dipping into long-term savings to cover short-term needs.

Tips to Build Your Emergency Fund Faster

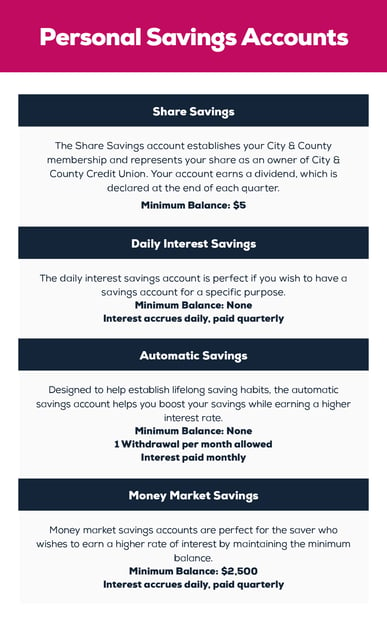

One of the easiest and most effective ways to begin building an emergency fund is by opening a high-yield savings account. This type of account offers a higher interest rate than a traditional savings account, meaning that your money can grow faster over time.

opening a high-yield savings account. This type of account offers a higher interest rate than a traditional savings account, meaning that your money can grow faster over time.

Another tip to kickstart your savings strategy is to set up automatic, routine transfers from your checking account to your savings account. With this method, you can schedule a specific amount to transfer on a regular basis, like every payday or once a month. This way, you won't have to remember to move money over to savings — let technology do all the hard work for you!

By taking advantage of these savings tips, you can build an emergency fund that will give you peace of mind and protection from unexpected expenses. And, as your emergency fund grows, you'll be one step closer to achieving your financial goals and creating a more secure future for yourself.

Look Down the Line: Retirement Savings

We get it — retirement might feel like a lifetime away. With so many things going on, it can be hard to prioritize planning for your future financial self. But the sooner you start thinking about retirement, the stronger your savings strategy can be. Consider contributing to a 401(k) or individual retirement account (IRA) to ensure a secure financial future.

Tips to Retire in Style: 401(k)s and IRAs

If you're looking for a reliable way to save for the future, a 401(k) is a great place to start. This employer-sponsored retirement plan allows you to contribute pre-tax dollars towards your savings, which can help lower your taxable income and increase take-home pay.

In addition to many tax benefits, employers may match contributions to their employees’ 401(k) accounts. This means that for every dollar you contribute to your 401(k), your employer could contribute a certain amount as well. Contribution matching can significantly boost your savings and help you to reach retirement goals even faster.

Another tool to plan for retirement is by opening an individual retirement account (IRA). Unlike a 401(k), an IRA is not tied to an employer and can be opened by anyone with earned income. This means you can control your retirement savings and tailor your investment strategy to your individual needs and goals.

One of the primary benefits of an IRA is the potential for tax savings. Depending on the type of IRA you choose, your contributions may be tax-deductible, and your earnings can grow tax-free until you withdraw the funds in retirement.

Utilizing both of these retirement planning tools, a 401(k) and IRA, can help you build a robust retirement portfolio while securing significant savings for the future!

Dig Into Debt: Repayment Planning

When thinking about a savings strategy, you need to take into account any high-interest debt you may have. This could include anything from credit card balances to student loans with high-interest rates.

It’s no secret that high-interest debt can spiral out of control quickly, making it hard to save for any future goals. By paying off these debts as soon as possible, you will be free to focus on future investments. Not only will this help you achieve your financial goals faster, but it will also save you money in the long run by reducing the amount of interest you pay over time.

Tips to Demolish Debt

It’s important to remember that paying off debt takes time and effort, but it’s an essential step to achieving financial freedom. Try these strategic steps to get started:

- Create a budget: List your monthly income and expenses to identify areas where you can cut back on unnecessary spending.

- Prioritize high-interest debt: Identify debt with the highest interest rates and focus on paying it off first.

- Consider consolidation: If you have multiple high-interest debts, consider transferring the balances to a single, lower-interest account or consolidating the debts to a single loan.

By putting a plan into place to pay off your debts, you are setting yourself up for a more secure financial future.

Think Pink

Life gets hectic and planning for your financial future can seem overwhelming — but it doesn’t have to be. With the right tools, strategies, and support, saving can be simple and straightforward.

At City & County Credit Union, we understand the importance of financial security and are committed to helping our members create a path toward their savings goals.

With a variety of savings accounts, retirement planning options, and expert guidance, we can help you navigate the complex world of personal finance with ease. We also offer convenient and accessible digital financial services, making it easier than ever to manage your money on the go.

Don't let financial stress hold you back from achieving your dreams. Contact us today, and let us help you build a better financial future!