Are you struggling to find a financial institution best suited to your needs? Are you searching for a way to save money, access more services, and make the most of your finances? It takes time, we get it. The finance world can be a bit tricky to navigate on your own. Lucky for you, we’re here to help!

Both for-profit banks and credit unions offer economic advantages, from loans and investment opportunities to savings and checking accounts. They also have distinct differences that can impact how you manage your money. In this blog, we'll explore some of these differences so you can feel empowered to make the best decision for your financial situation.

Credit Unions vs For-Profit Banks — An Overview

The biggest difference between a credit union and for-profit bank lies in who they serve. Credit unions are non-profit and member-owned, meaning they are owned by the people who have accounts with them. They often offer more competitive rates on products, including checking accounts, savings accounts, loans, debit cards, and mortgages. Banks, on the other hand, are for-profit and customer-oriented, and their customers may not have any connection beyond the financial relationship.

Credit unions tend to be smaller, more localized in scope, and often specialize in certain industries. This can offer members a more personalized experience and a better understanding of the specific needs of each member. Banks, by contrast, are usually much larger, national and international in scope. While they may offer a broader range of services, banks may not be as specialized in their approach.

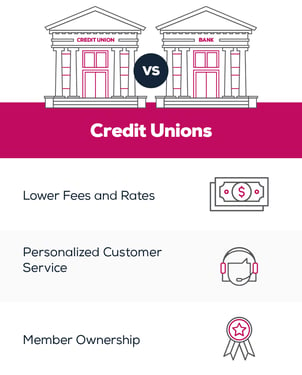

Why Choose a Credit Union?

Credit unions are a great option for banking services and offer a variety of advantages over traditional banking institutions. Here are three reasons to consider a credit union:

Lower Fees and Rates

Credit unions often offer lower rates and fees than traditional banks, translating into better deals for customers. They are also exempt from many of the taxes that larger banks are subject to, allowing them to pass these savings on to their members.

Personalized Customer Service

Because of their localized nature, credit unions often provide personalized customer service with friendly and knowledgeable staff. They can be more responsive to their members’ inquiries, working tirelessly to deliver solutions that meet individual needs. For example, the entire staff at City & County Credit Union is part of the same local community as their members — giving them firsthand experience to understand their member’s needs.

Member Ownership

Unlike traditional banks, credit unions are owned by the members, meaning they are more invested in the organization. This also allows members to have more control over their finances and take a hands-on approach to how their money is handled.

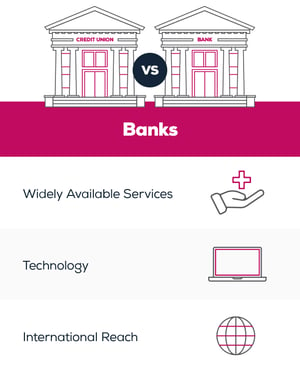

Why Choose a For-Profit Bank?

Just by hopping in a car and driving down any metropolitan road, it's easy to see that banks play an integral role in today's financial industry. They offer a wide range of services designed to make managing money easier. Here are three advantages to picking a bank for your financial needs:

Nationwide Branch Locations

Banks often tend to customers across the globe, boasting a wide range of services from savings and loan products to international services. With nationwide branch locations, for-profit banks can make managing your money a breeze if you travel frequently.

Unique Technology

Most for-profit banks rely on the latest and greatest technology to make the banking process more efficient and secure. This includes biometric authentication, budgeting software, or other wealth management services that allow you to streamline finances.

International Reach

Banks are more likely to offer international services, like foreign exchange and payments. Not only does this allow you to transfer funds to other countries quickly and securely, but it makes it easier to conduct business with people abroad while accessing global markets.

Credit Unions vs For-Profit Banks — Things to Consider

Finding the right bank or credit union can be challenging. But finding one that speaks directly to your financial needs shouldn’t be. Take time to reflect on all of the following factors, it can make all the difference for your future financial self.

What Are Your Financial Needs?

Consider your current financial situation and determine your future financial goals. What products or services will help you get there? Paint a picture of your financial plans, including the necessary products like savings, loans, credit cards, or investments.

What Are Your Options?

Gather information on local credit unions and banks. How do their interest rates, fees, accessibility, and reputations compare? Do you prefer personalized customer service or global banking capabilities?

Do You Meet Membership Requirements?

Because credit unions are not-for-profit organizations, their membership eligibility may be more restrictive than those of banks. If you’re leaning towards opening an account at a credit union, ensure you meet the membership requirements, which are often based on where you work or live.

At City & County Credit Union, we proudly deliver a different way to bank to members who live, work, worship, volunteer, or attend school in Carver, Hennepin, McLeod, Meeker, Ramsey, Washington, Wright, or Northern Dakota County and employees, retirees, and family members of General Mills.

Think Pink

At City & County, we believe in providing affordable financial solutions. Although there are advantages and disadvantages to both banks and credit unions, we’re proud to offer many of the same services as big-box financial institutions with the personalized touch of a local credit union.

From savings and checking accounts to consumer loans and mortgages, our members are rewarded with better rates, fewer fees, and attentive customer service. Come see for yourself!